Table of Contents

What is a Crypto Token? and its 9 Main Types

Listen to the Audio :

Undoubtedly, cryptocurrencies have established a benchmark in recent years and have gained significant attention. They are one of the most effective ways to transform current financial transactions. If you are a techie or an unknown individual with an interest in finance, then it's crucial to understand what a crypto token is.

Yes, a crypto token has a giant range of scalar potential to make decentralized exchanges like any other cryptocurrency using various platforms like Ethereum, Solana, and Binance Smart Chain (BSC).

If you're ready to enter the crypto world, then this blog has all the basics about crypto tokens and the best platforms you need to know. Besides this, it also gives you an overview of the features and benefits of a token that you must really understand and helps you create your own crypto token with ease.

What is a Crypto Token?

In the simplest form, a crypto token is a digital representation that is built within a blockchain environment to facilitate transactions. A token is different from a cryptocurrency because cryptocurrencies have their own blockchain, whereas tokens will run on existing blockchain platforms.

Apart from other standalone cryptocurrencies such as Bitcoin, crypto tokens operate on platforms like Ethereum, Solana, and Binance. However, you can use a crypto token to store values confidentially, invest, or make purchases when necessary.

Such an instance probably represents data, which may be a person’s secured credentials or information stored within a database. Moreover, it can represent a wide range of assets, right from art to property.

9 Main Types of Crypto Tokens

Crypto tokens come in various types, each serving a unique function. With these services, here come the most popular and top digital crypto tokens for your reference along with a brief description.

Security Tokens

A security token is created, representing a digital asset of ownership, similar to traditional financial securities like bonds, stocks, and real estate. The process of creating a security token involves tokenizing an asset, that is, converting it into a digital representation on a blockchain.

By digitizing these assets, security tokens enhance liquidity by making investments more accessible to global markets. Furthermore, keep in mind that retail U.S. investors do not yet have access to security tokens, but the regulators will soon approve them.

Utility Tokens

The utility tokens, also known as user tokens, are intended to provide access to specific services, products, or functionalities within a blockchain-based platform, rather than being primarily intended as an investment.

Typically, these tokens are created through an initial coin offering (ICO) or token sales, where investors can purchase the tokens in exchange for other cryptocurrencies such as Bitcoin or Ethereum. Once done, the users can use utility tokens to pay for services, access premium features, or participate in decentralized applications (dApps).

Non-Fungible Tokens (NFTs)

The NFTs denote ownership of unique digital or physical assets such as artwork, real estate, music, or collectibles, which are not interchangeable. These NFTs are powered by smart contracts published to the blockchain networks. Furthermore, once the blockchain records ownership, one can sell and trade the NFTs.

Governance Tokens

The governance token, a type of cryptocurrency, allows owners to participate in the decision-making process of a blockchain project. In contrast with the utility tokens, the governance tokens mainly allow the holders to influence a project’s management and direction. These are typically used in decentralized autonomous organizations (DAOs) and decentralized finance (DeFi) projects.

Decentralized Tokens (DeFi)

DeFi is an emerging peer-to-peer financial system that uses blockchain and cryptocurrencies to create and manage a decentralized blockchain network. This is a new world of cryptocurrency-based protocols that aim to multiply traditional financial system functions. Most likely, we can accomplish these goals without the need for a central authority or intermediary.

Stable Coins

A stable value can also be maintained by cryptocurrency in the form of stablecoins (digital assets). Moreover, these coins are backed by legal tender, such as the U.S. dollar, which functions in storing value. Smart contract algorithms, acting as a bridge between traditional finance and cryptocurrencies, likely stabilize it, enabling safer and more stable transactions.

Asset-Backed Tokens

Asset-backed crypto tokens are digital representations of real-world assets on a blockchain, which is similar to a stablecoin. These tokens provide a way for startups to secure their assets and offer them to investors.

Payment Tokens

Payment tokens are one such cryptocurrency that is designed for payment transactions. They are placeholders or identifiers that represent sensitive payment data. People exchange these tokens for goods and services or use them for money transfers. However, these unique tokens enhance security by preventing the storage or transmission of actual data.

Privacy Tokens

Privacy tokens, also known as privacy coins, are cryptocurrencies that focus on keeping the sender’s and recipient’s transactions private and unknown. As these tokens use advanced cryptographic techniques to save the information and make the transaction confidential, they can be widely used for personal and business purposes.

Some of the techniques that privacy coins use are stealth addresses and ring signatures.

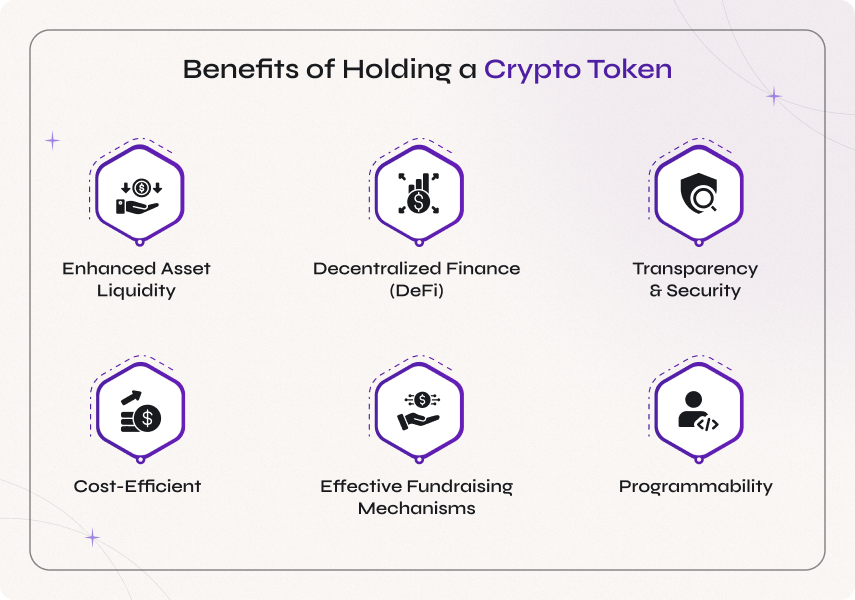

Benefits of Holding a Crypto Token

As an investor, you can select the ideal crypto token for your needs by analyzing its features. Below are the efficient features of crypto tokens that you must take a glance at.

Enhanced Asset Liquidity:

Tokenization allows real-world assets to be represented as digital tokens, enhancing easy trading and accessibility. Here, artwork, real estate, and company shares can be tokenized, and investors can buy and sell smaller portions without the need for full ownership.Decentralized Finance (DeFi):

Crypto tokens are more crucial for DeFi, which allows peer-to-peer transactions and financial services without traditional intermediaries. This inventive idea allows users to decentralize lending, trading, and borrowing.Transparency and Security:

Every transaction in the blockchain is recorded immutably to prevent fraud and uncertified changes. Additionally, the use of smart contracts ensures an automated and secure execution of agreements.Cost-Efficient:

Unlike traditional banking systems, crypto tokens make fast and low-cost international transfers without intermediaries. In addition to this, crypto tokens are cheaper due to minimal intermediary fees, especially for cross-border transactions.Effective Fundraising Mechanisms:

Crypto tokens are used in various fundraising methods such as Security Token Offerings (STOs), Initial Coin Offerings (ICOs), and Initial Exchange Offerings (IEOs), which provide access to a global network of investors.Programmability:

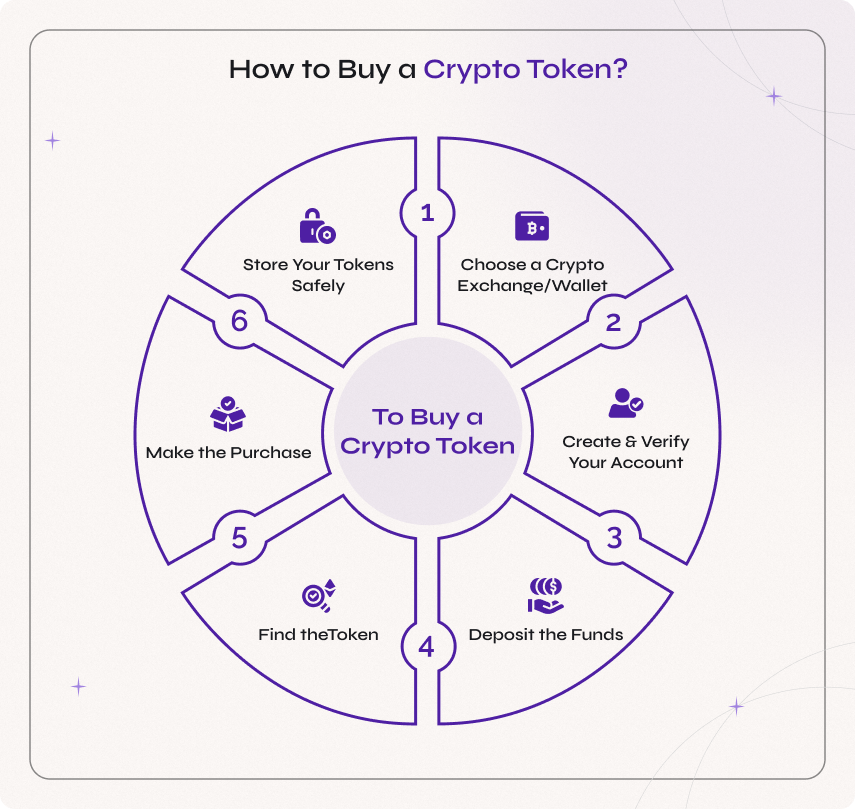

Crypto tokens are integrated into smart contracts to enable programmable functionalities such as governance, automated payments, token burns, and supply chain processes.How to Buy a Crypto Token?

If you are new to the world of crypto tokens or cryptocurrency, learning how to purchase a crypto token might be an overwhelming process at the beginning. However, the purchase steps might be pretty straightforward once you understand the procedure. Here are the six simple step-by-step processes to ensure a smooth start to your token purchase.

Step 1: Choose a Crypto Exchange/Wallet

The initial step in purchasing a crypto token is to select or choose the right crypto exchange or wallet. Normally, each crypto exchange has a set of rules for buying, selling, and trading. Among them, the top crypto exchanges that are worth considering are Binance, Kraken, and Coinbase.

So, as an investor, you need to choose an exchange that allows fiat currency deposits (like U.S. dollars). Once chosen, the crypto must be transferred to your wallet, which might be a Trust Wallet or a MetaMask.

Step 2: Create and Verify Your Account

Once you have chosen the exchange and finished setting up your wallet, the next step is to create an account. To do so, follow the on-screen instructions to choose your preferred wallet for depositing. Additionally, you must meet the requirements based on your chosen platform and trading volume, and do the necessary two-step authentication for a secure process.

Step 3: Deposit the Funds

To buy the crypto token, you need to add money to your exchange wallet. So, continue the process by linking your bank account or using a debit or credit card. Additionally, you can use online payment platforms like PayPal or UPI payments.

Step 4: Find the Token

Once you have deposited the funds in your wallet, you need to find and check whether your token is secure and scam-free. To do so, get a trusted source like CoinGecko and input your token’s IP address to check its safety and protection.

Step 5: Make the Purchase

Now, make the purchase by choosing a trusted decentralized exchange platform that supports the wallet you have chosen already. We suggest using Uniswap for Ethereum-based tokens and PancakeSwap for BNB Smart Chain tokens. Once done, connect your wallet to the decentralized exchange and make sure you are on the correct network.

Step 6: Store Your Tokens Safely

As a final step, your new token must show up in your wallet. Suppose you can’t find yours; you can do it manually using the IP address. Beware of scams and make sure your token is safe and secure.

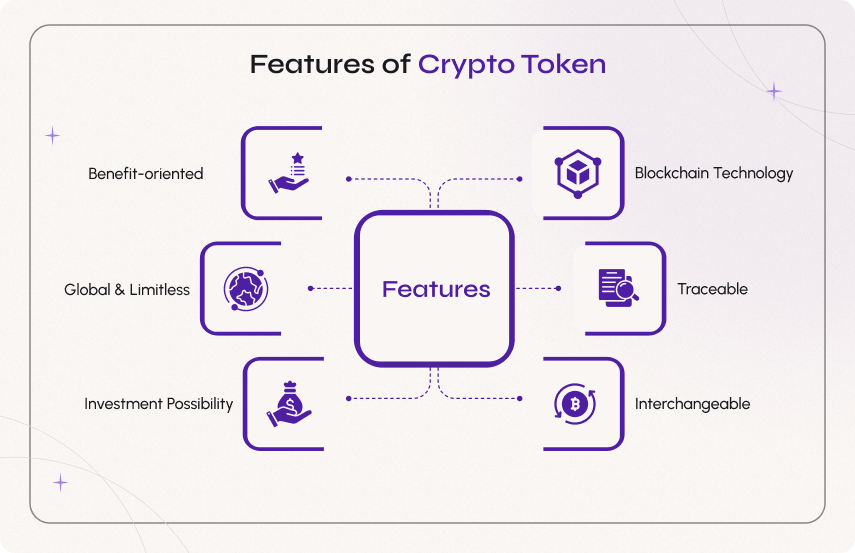

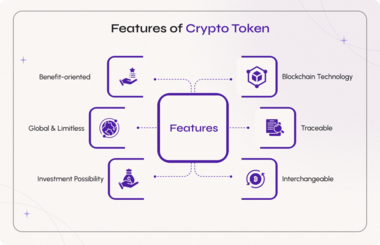

Features of Crypto Token

Here are some of the key features of crypto tokens, which make them a definite and effective tool in the blockchain ecosystem.

Blockchain Technology:

The crypto tokens are built on blockchain technology, which ensures safe and secure transparency.Interchangeable:

Each crypto token is unique and represents distinct data, which cannot be altered or tampered with by any third person.Traceable:

Every transaction in a token is traceable on the blockchain, enhancing the risk of fraud.Global and Limitless:

The crypto tokens can be accessed and used anywhere in the world and are a wonderful companion for international transactions.Investment Possibility:

Crypto tokens are traded on global markets 24/7, which attracts investors and traders.Benefit-oriented:

Most crypto tokens come with specific functionalities such as paying transaction fees, rewards or incentives, voting rights in governance, and access to a specific product or service.Best Platform to Exchange a Cryptocurrency Token

Cryptocurrency exchanges are online platforms that are used to trade and sell cryptocurrencies when needed. Companies or other organizations host these exchanges, prioritizing user experience and security. These exchanges provide access to a wider range of cryptocurrencies and trading partners, making it easier to find and trade different assets.

When looking for an exchange platform, it’s essential to do more research on the key storage, accounts, security, features, and wallets. So, read the following section to get access to the advanced and best crypto exchange platforms.

Kraken

Kraken is a US-based cryptocurrency exchange that allows users to trade with popular digital assets like Ethereum and Bitcoin. The service mainly focuses on security and was rated as one of the first platforms to offer spot trading with margin. Kraken allows users to trade over 200 digital assets and 6 different national currencies.

Available Cryptocurrencies in Kraken: 120

Binance

The Binance exchange is one of the leading cryptocurrency exchanges by trade volume compared to others. It provides a crypto wallet for traders to store their digital funds safely and securely. On top of that, Binance has its own blockchain-based token, called BNB.

Available Cryptocurrencies in Binance: 350+

Coinbase

Yet another popular cryptocurrency exchange is Coinbase, which offers a simple and sleek interface. It offers an advanced trading platform with low fees and professional-grade tools for more experienced traders and allows new crypto trading investors to access its newest features.

Available Cryptocurrencies in Coinbase: 240+

Gemini

Gemini is a regulated cryptocurrency exchange platform with a website and a mobile app to provide an easy way for buying, selling, storing, and trading cryptocurrencies. This platform mainly focuses on a safe future and convenience.

Available Cryptocurrencies in Gemini: 150+

Mudrex

Mudrex leads as the most versatile and compliant crypto investing app among others. With its sharp focus on user safety, diverse selection of tokens, investor education, and strong customer support, Mudrex has been one of India’s widest selections over the past years.

Available Cryptocurrencies in Mudrex: 350+

CoinSwitch

CoinSwitch stands as one of the most popular crypto exchange aggregator platforms. This platform is more secure and user-friendly and can be used to buy cryptocurrencies like Ethereum, Bitcoin, and Ripple. With its advanced trading tools, one can experience instant coin exchange and seamless transactions to protect assets.

Available Cryptocurrencies in CoinSwitch: 300+

Uniswap

Uniswap is one of the largest decentralized exchange platforms, which runs on the Ethereum blockchain. Moreover, it is open-source, which allows users anywhere in the world to trade crypto without an intermediary. UNI holders govern this platform, overseeing the protocol.

Available Cryptocurrencies in Uniswap: 1300+

CoinDCX

CoinDCX is one of the best crypto exchanges in India, which is well known for its security. This platform has a user-friendly interface, along with seamless buying, selling, and trading services. Besides, it is a reputed platform, well known for its safe exchanges, with a valuation of $1.1 billion.

Available Cryptocurrencies in CoinDCX: 500+

6 Easy Steps to Create Crypto Token

As an initial step in creating a crypto token, investors need to understand the blockchain technology, its mechanisms, and the legal considerations. Once you create your own crypto token, you can use it for fundraising for new projects, user participation in governance or rewards systems, and representing real-world assets on the blockchain.

So, here are the simple procedures to guide you on where and how to create your own crypto token.

Step 1: Identify Your Token’s Purpose

If you really want to create a new or innovative crypto token of your own, then the first step is to determine the purpose of its origin. It may represent assets, reward users, or serve another specific application. However, the source should demonstrate the significance of its design, supply, and features, as well as the quality of its formulation.

Step 2: Select the Right Blockchain Platform

Once you have identified the purpose of your token, the next step is to choose the blockchain platform. This will wisely depend on the specific needs of the cryptocurrency and the blockchain your token is going to use. The leading platforms include Ethereum, Binance Smart Chain (BSC), Solana, and Avalanche.

Ethereum is the most popular platform with the largest ecosystem of decentralized applications, and Binance is also one of the most widely used platforms with low transaction fees. Meanwhile, Solana and Avalanche are well known for their high speed and rapid transaction finality.

Step 3: Create Your Token

Once you've selected the ideal blockchain platform, you need to design the cryptocurrency with user-friendly features and specific key attributes. Moreover, these tasks can be done without writing any code or seeking help from a blockchain developer.

For example, you can use existing blockchains like Ethereum to create your own tokens by filling out simple forms specifying the name, initial supply, and symbol. Moreover, you can even get help from the crypto token development services to make sure your token is firmly built.

Step 4: Testing and Launching Your Token

The next part is to test your token before launching it. This step is a major factor in verifying the token's format and ensuring it is bug-free through thorough testing. Once your token has achieved the expected performance, it will be processed to live on the blockchain.

On the side, you need to pay the gas fee for deploying the token on the blockchain, which means confirming your token on the network. By doing so, this marks the beginning of the journey.

Step 5: Verify the Token Creation

After completing the transaction, wait for some time until the blockchain processes it and get the unique address for your token. The address is nothing but a unique identifier for the particular token. Using this address, you can verify, track, and monitor the transactions. Moreover, a cryptocurrency developer will use these addresses to supervise and interact with the tokens easily.

Step 6: Promoting and Maintaining Your Token

Once you've finished developing your own cryptocurrency, you must promote it to increase usage. You can start this by listing your token on exchanges where users can buy and sell it.

Moreover, you can make it public via social media or any other trusted platform to highlight its value and to advertise your token. Once you have created trust and encouraged people to use your token, it’s important to maintain it periodically and to keep it error-free.

Conclusion

In summary, it is clear that crypto tokens have a wide range of potential features and will continue to grow significantly in the digital and financial systems forever. By going through the trading processes of a token and by analyzing the best platforms to exchange it, an investor can confidently invest in purchasing the best tokens like NFTs, stablecoins, and DeFi.

Moreover, understand the steps involved in crypto token development and bring your own token to create innovative solutions in the digital economy by offering a convenient way to participate in financial markets with enhanced privacy and security.