Table of Contents

Top 10 Cryptocurrency Exchanges in USA - Expert Picks

Listen to the Audio :

In the USA—Cryptocurrency trading is booming & attracting both beginner and experienced traders to the world of digital assets such as Ethereum, Bitcoin and others. Picking the top cryptocurrency exchanges in USA is essential for a secure, easy and profitable trading experience since there are so many exchanges available.

U.S based exchanges provide multiple options from user friendly interfaces to high security and minimal trading fees regardless of your level of experience. Popular brands like Coinbase, Kraken and Gemini set the standard while others provide advanced features that meet various trading preferences.

Every platform has unique user experiences, fee structures, supported coins and strengths. You can trade more confidently and smartly if you are aware of these differences. Additionally, businesses and entrepreneurs who are looking to build their own platforms can partner with our reputable cryptocurrency exchange software development company to offer tailored solutions and match their market needs.

The best cryptocurrency exchanges in the USA will be examined in this article along with their special perks to assist you in selecting the best platform for your crypto world.

What to Look For In a Crypto Exchange

A suitable cryptocurrency exchange is essential for a safe and easy trading process. Here are some important things to consider

Security

Seek platforms with robust security features such as cold storage, two factor authentication (2FA) and digital asset insurance.

Regulatory Compliance

To increase safety—ensure the exchange complies with local laws and operates lawfully in the United States.

Fees

Verify the costs of deposits, withdrawals and trading. Overtime low fees might save you a lot of money.

Supported Coins

Select a cryptocurrency exchange that provides an extensive list of the coins you want to trade or invest in

User Experience

Especially for beginners, a responsive mobile app and a clear, easy to use UI make a significant impact.

Customer Service

Whenever financial transactions are involved, prompt, reliable support is necessary.

Liquidity

Better price execution and quicker trades are guaranteed by high liquidity.

The 10 Top Cryptocurrency Exchanges in USA

Coinbase

One of the most reliable and user friendly cryptocurrency exchanges in the US is Coinbase. In addition to being openly listed on the NASDAQ, the platform is completely regulated.

Coinbase which is well known for its clear user interface and educational content makes it simple for anyone to purchase, sell and store cryptocurrencies. In addition to supporting more than 250 cryptocurrencies, the exchange provides features including safe wallets, staking rewards and recurring purchases.

Coinbase Advanced Trade—it is a more advanced version that offers more innovative tools and reduced fees to cater to expert traders. Many people choose Coinbase because of its reliability and simplicity of use even though its costs are a little higher than those of certain competitors.

Pros of Coinbase

Highly intuitive UI for beginners

Publicly traded & completely regulated (NASDAQ)

Accepts more than 250 cryptocurrencies

Provides rewards for learning and staking

Strong reputation & High liquidity

Cons of Coinbase

Fees are higher than on other exchanges

Few options for customer service

Advance trade is a separate platform

Kraken

Kraken has long been the preferred & best cryptocurrency exchange in USA for experienced traders and institutions due to its strong security and top notch trading features. It provides spot trading, futures trading and leveraged margin trading and it supports more than 200 cryptocurrencies.

Kraken is renowned for its security track record as well; since its 2011 arrival it has never seen a significant hack. For beginners—its user interface can be more complicated but for more advanced users, its mobile app and Kraken Pro platform offer flexibility. In the United States it is a completely regulated exchange that is highly regarded for its transparency and dedication to legality.

Pros of Kraken

Superior security track record

Facilitates margin trading & futures

Kraken Pro offers low trading fees

More than 200 coins are supported

High adherence to regulations

Cons of Kraken

Beginners may find the interface confusing

Limited coin availability relative to global exchanges

Certain functions are not available nationwide

Crypto.com

One of the biggest cryptocurrency ecosystems is Crypto.com which has expanded quickly and now provides an exchange, a mobile app, a Visa debit card, DeFi services and access to the NFT marketplace.

It offers affordable costs and supports more than 250 coins particularly for customers who invest in its native CRO token. Due to legal constraints–U.S. customers can only access a slightly restricted version; yet because of its extensive features and product offerings, it continues to be a top platform. Casual users who want to incorporate cryptocurrency into their daily lives are drawn to its attractive mobile app, rewards program and cryptocurrency payback card.

Pros of Crypto.com

Whole mobile app ecosystem

Supports more than 250 coins

A Visa card with cashback crypto is available.

Binance.US

Binance.US is the American branch of Binance, the top crypto exchange in usa globally in terms of volume. With trading fees as low as 0.1% it provides access to a large variety of coins.

Because of U.S. rules it lacks the full functionality of the worldwide binance platform but it is still a strong choice for traders on a budget. Binance.US provides staking options, recurring buys and sophisticated charting tools. Users should check availability based on their area though, as access can be restricted in some countries due to licensing limitations.

Pros of Binance

The trading fees are extremely minimal as low as 0.1%

Sophisticated charts and trading tools

Available options for staking

Supports more than 100 coins

Cons of Binance

Fewer features than Binance worldwide

Restricted accessibility in several U.S states

Uncertainty in regulations

Gemini

This is a top cryptocurrency exchange in USA founded by the Winklevoss twins and is renowned for placing a high priority on security and compliance. It supports more than 500 cryptocurrencies and offers an easy to use interface, a safe wallet, a rewards card and interest-earning opportunities through Gemini Earn.

With Gemini Active Trader’s advanced trading interface, the platform is ideal for both beginner and experienced traders. One of the few exchanges that complies with some of the strictest financial regulations in the United States is Gemini, which is a New York State Trust Company.

Pros of Gemini

Superior security and adherence to regulations

Ideal for novices and experts alike

Uses Gemini earn to offer interest

User friendly mobile apps and interface

Trust status in New York (tightly controlled)

Cons of Gemini

Fees are higher than competitors

Lower coins than larger exchanges

Certain awards are region-specific

eToro

The social trading website eToro offers a special feature called CopyTrading in addition to cryptocurrency trading. This feature enables users to automatically copy and follow the trades made by high-performing investors.

Even though eToro does not support as many cryptocurrencies it's still a great platform for users who want to build diversified portfolios that include stocks and ETFs or learn from others. For new investors looking for multi-asset exposure with a social twist—eToro is perfect as it is regulated in the United States offers a seamless mobile app experience and has integrated educational content.

Pros of eToro

Unique copy trading and social trading features

Permits trading in stocks and cryptocurrencies

Governed in the united states

User friendly UI for beginners

Integrated educational content

Cons of eToro

Restricted choice of coins

Some assets' private wallets are inaccessible

Spread-based pricing gas as an alternative to open fees

BitMart

With support for more than 1000 cryptocurrencies—BitMart is a global United states based crypto exchange that has become popular. BitMart is ideal for users seeking access to low-cap or emerging tokens not listed elsewhere.

In addition, BitMart provides launchpad token sales, staking services and spot and futures trading. Although BitMart is less regulated than Coinbase or Gemini, it nonetheless offers reliable functionality for more adventurous traders. Given that the platform was breached in 2011 but has since improved its security which is an important factor.

Pros of BitMart

Large multiple altcoins (1000+ coins)

It offers spot trading and futures

New crypto project launchpad

Options for staking and passive income

Cons of BitMart

A past security breach (2021)

It is not entirely regulated in the United states

For new users, the interface may appear cluttered

KuCoin

Another well known exchange worldwide that caters to American customers is KuCoin despite not having a US license. Despite this it is still quite popular because of its large range of coins, cheap fees and advanced features like automated trading bots, margin trading and crypto lending.

Additionally—KuCoin offers trade discounts and rewards through its native coins, KCS. Although KuCoin is best suited for seasoned users who are at ease with unregulated platforms, high-volume altcoin traders find it to be an appealing option due to its sophisticated toolkit and substantial trading volume.

Pros of KuCoin

Supports more than 700 coins

Advanced features - bots, loans and margin

Minimal trading costs and trading contests

You can earn rewards & discounts with Coin Token (KCS)

Cons of KuCoin

The company is not formally licensed in the United States

Limited help from fiat

High regulatory risk

Robinhood

Popular cryptocurrencies like Bitcoin, Ethereum and Dogecoin can be traded easily and without fees with Robinhood which is renowned for popularizing commission-free stock trading. For beginners particularly those who are already experienced with stock investing, the platform is perfect.

The platform just announced its Robinhood Wallet to provide customers more control over their assets although its cryptocurrency features are more restricted (for example - users cannot withdraw the majority of their cryptocurrency to external wallets). For occasional investors who would rather use a single platform for both stocks and cryptocurrency it is a fantastic choice.

Pros of Robinhood

Cryptocurrency trading without commissions

An incredible user friendly UI for beginners

It integrates cryptocurrency, ETFs and stocks into a single app

Recently it added the feature of a cryptocurrency wallet

Cons of Robinhood

Coin selections are limited

Restrictions on withdrawals (limited wallet support)

Absence of advanced trading tools or features

Coincheck

Recently, Coincheck—a cryptocurrency exchange based in Japan increased its market share in the United States. Coincheck which is well known in Japan for its user-friendly interface and regulatory compliance provides an expanding range of cryptocurrencies and places a strong emphasis on security and use.

Although it is still building its name in the United States, its growth indicates that American traders will have more options and face greater competition. Given Coincheck’s goals to expand its global services, it is a suitable option for customers wishing to investigate foreign networks with a strong security focus.

Pros of Coincheck

The interface is clear and easy to use

High levels of compliance in Japan

For beginners exploring abroad

Strong emphasis on security

Cons of Coincheck

Limited availability and features in the US

Smaller coin selection than others

Being established in the U.S

Quick Comparison—USA Crypto Exchange Features

| Exchange | Supported Coins | Fees | Regulation & Compliance | Security Rating | Beginner Friendly | Notable Features |

|---|---|---|---|---|---|---|

| Coinbase | 250+ | High | Completely regulated (NASDAQ) | Excellent | Yes | Staking, learning rewards & user friendliness |

| Kraken | 200+ | Low (Kraken Pro) | Regulated | Excellent | Moderate | Futures & Margin. Safe legacy |

| Crypto.com | 250+ | Medium (Lower with CRO) | Partial in U.S | Good | Yes | DeFi tools, NFT platform & Visa card |

| Binance.US | 100+ | Very low | Regulated (varies by state) | Good | Yes | Advanced trading and low fees |

| Gemini | 100+ | High | Strong Compliance | Excellent | Yes | Earn interest in a very safe way |

| eToro | 25+ | No Commission | Regulated in U.S | Good | Yes | CopyTrading, Cryptocurrency and stocks |

| BitMart | 1000+ | Medium | Not fully regulated | Moderate | Moderate | Huge altcoin selection, staking |

| KuCoin | 700+ | Low | Not U.S licensed | Moderate | Moderate | Bots, lending, margin trading |

| Robinhood | 15+ | Commission-free | Regulated in U.S | Good | Yes | Wallet integration & Stock + crypto |

| Coincheck | 20 (US Access) | Medium | Regulated in Japan | Good | Yes | Simple UI, strong in Asia |

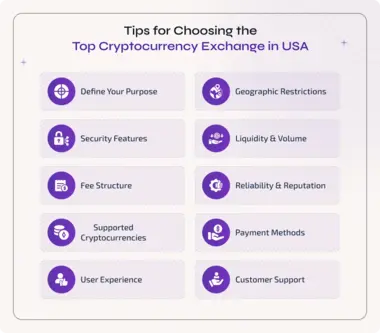

Tips for Choosing the Top Cryptocurrency Exchange in USA

Define Your Purpose

Before investing or trading cryptocurrencies—be sure you know why you need an exchange. Which one best suits your needs depends on your goal.

For long term investors - Seek exchanges with strong security and a solid track record of reliability.

For active traders - Give preferences to platforms with high liquidity, low fees and advanced charting tools.

For DeFi/NFT Users - Select exchanges that integrate with web3 wallets or support specific tokens.

Security Features

Your first concern should always be security. A secure exchange can protect your assets from fraud and hackers

Two factor authentication - An additional degree of security is added to your account

Cold wallet storage - This ensures that the majority of funds are kept offline and out of the reach of hackers

Regulatory compliance - Verify whether your country has granted the exchange a license

Insurance coverage - A few platforms protect against breaches

Fee Structure

Each exchange has a different cost structure that can affect your earnings particularly if you trade frequently

Trading fees - Typically determined by a flat rate or maker-taker model

Deposit/Withdrawal fees - These differ according to the coin or payment method

Hidden Costs - Watch out for exchanges with poor exchange rates or large margins

Supported Cryptocurrencies

Not every exchange supports all coins. Depending on your interests–this could be a deciding factor for you

Popular coins - Most platforms support Ethereum and Bitcoin

Altcoins - Select platforms like KuCoin or Gate.io if you are looking for more recent or specialized coins

Token standards - While some exchanges handle many chains others focus on ERC20 tokens

User Experience

User experience is important regardless of skill level Having an intuitive platform simplifies asset management

Beginner friendly UI - Look for learning resources, clear design and easy navigation

Advanced tools - Order books, margin trading and indicators are required by traders

Mobile access - Confirm whether the platform has a trustworthy app

Customer Support

Our prompt customer support can help you save time and worry if something goes wrong

24/7 Support - This feature is crucial for global users who live in different time zones

Live chat or ticketing systems - Options for quicker resolution are preferable

Community feedback - Check through reviews on Reddit or Trustpilot for real user experiences

Payment Methods

Our prompt customer support can help you save time and worry if something goes wrong

Fiat deposits - Find options like PayPal, credit/debit cards and bank transfers

Crypto only platforms - Keep in mind that specific exchanges need you to already have crypto

Local currency support - It avoids conversion costs and delays

Reliability & Reputation

It might be risky to trade cryptocurrencies so stick with exchanges that have a solid reputation and open trading

Exchange History - Examine past cyberattacks, legal issues or outages

Regulatory Status - Check whether the exchange complies with local laws

Public Reviews - Use platforms such as TrustPilot or CoinGecko to view ratings

Liquidity and Volume

Liquidity allows you to buy or sell quickly without major price fluctuations

High trading volume - It enables seamless execution especially for major trades

Top tier platforms - Liquidity is typically better on exchanges such as Coinbase or Binance

Pair availability - Working with a greater range of currencies is made possible by having more trading pairs.

Geographic Restrictions

Some exchanges are not available in every country due to regulatory restrictions.

Check availability - Confirm the exchange that supports your country

KYC Requirements - Be prepared to present supporting documentation for identity confirmation

Localized platforms - Consider exchanges that provide localized payment options or customer service

Launch Your Own Crypto Exchange Easily

One effective strategy to get into the rapidly expanding digital asset market is to learn how to create crypto exchange platforms. Although it has huge financial potential it also necessitates thorough planning, strong security and complete regulatory compliance. Every aspect counts from selecting the best blockchain infrastructure to implementing KYC/AML processes and liquidity solutions.

Whether you are creating a centralized or decentralized platform, user experience, legal licensing and market trust will all be important factors in determining your success.

Working with skilled programmers and blockchain experts is necessary to navigate the complex ecosystem.

Here Is What You Need

Technical Infrastructure

Choose between creating a platform or using a white label exchange. Make sure your architecture is built with the newest blockchain technology is scalable and enables fast transactions and has a reliable back-end.

Licensing & Regulation

Adhere to U.S. regulations including those related to FinCEN registration, SEC rules and specific state requirements. In addition to protecting your company and preventing potential closures or fines—legal compliance fosters trust

Robust Security

Use robust security features to protect users such as end to end encryption, cold wallet storage and two factor authentication (2FA), defense against DDoS attacks and frequent audits to guarantee the integrity of your exchange platform

Liquidity Management

Connect to outside liquidity providers or create internal liquidity pools to preserve market efficiency. We prevent slippage that could detract from the customer experience guarantee competitive pricing and ensure seamless transactions.

KYC/AML Compliance

Adopt comprehensive anti money laundering (AML) and know your customer (KYC) procedures. To identify users, stop fraud and meet all global regulatory requirements utilize both automated tools and manual verification.

User Friendly Interface

Create an easy to use user interface. Use adaptable design, easy navigation, real time trading charts and learning tools to help users of all skill levels from movies to experts.

Marketing & Branding

Establish a powerful brand voice and visual identity. Create social media campaigns, community involvement strategies and SEO friendly content to increase trust and attract repeat customers

Support and Maintenance

We provide prompt, 24 hour customer support via help centers, email and chat. Keep your platform up to date with frequent upgrades, performance advancements and timely bug or vulnerability fixes.

Crypto Exchange Development with BlockchainX

The leading crypto exchange development company BlockchainX focuses on creating robust, safe and expandable cryptocurrency trading systems. BlockchainX offers end to end solutions for centralized (CEX), hybrid and decentralized crypto exchanges depending on your business model whether you are a startup or an established company. Our speciality is providing high-performance systems with strong security features, complete regulatory compliance and a smooth user experience.

A high speed matching engine that can handle thousands of transactions per second is at the core of every exchange guaranteeing real time order matching and a seamless trading experience.

BlockchainX stands out as a reliable partner in the crypto exchange development. The fact that BlockchainX has built successful systems all over the world, making it stand out as a reliable decentralized exchange development company and partner in cryptocurrency exchange development. Our talented team develops feature rich, scalable and compliant platforms that help businesses dominate the rapidly growing market for digital assets.

Conclusion

Mastering the cryptocurrency trading market begins with selecting the appropriate exchange. Each platform provides unique advantages tailored to different kinds of traders from user experience and trading fees to security and compliance. From novice investors seeking user friendly platforms to seasoned investors seeking advanced features—there is a reliable exchange in the US cryptocurrency industry.

If you are still not sure, take your time & pick the platform that meets your needs the best. Safety should come first. Look at the features and think about your long-term trade goals. Refer to our carefully chosen list of crypto exchanges in USA to find the one that works efficiently.

Contact our specialists now for specialized guidance on starting your crypto journey and trading with trust.