Table of Contents

Detailed Guide on Tokenization of real estate using blockchain technology

Listen to the Audio :

Introduction

In 2018, the start of a new era in the tokenization of blockchain, Swift's adoption percentage and innovation aspect of the sector have proved to be a great investment opportunity over seeding traditional instruments. One such traction-gaining niche is Real estate tokenization, a bombarding investment tool. As the potential unlocks, the opportunities unfold which are transformative and scalable using real estate tokenization services. There have been several experiments, discoveries, and learning in the process to understand the knock to work out real-world asset tokenization.

Eventually, the Forbes report says that the market size of Real estate tokenization would surge to 18.2 Billion dollars in 2031, which indicates its potential caliber. Let us here unleash what real estate tokenization is, its benefits, technological advancements, and much more contributing to the fact that tokenization of Real Estate using blockchain.

What Is Real Estate Tokenization?

For traditional investors, this is going to be a big shock, but stay calm and explore. It's not very common for us to put our hard-earned money into a digital token, that you barely could feel, or even showcase. This tokenization process of converting real estate properties, or assets as tokens on the blockchain which is a digital identity for the asset, represents ownership, and can be fractionalized into multiple parts where each part holds its identity and is revenue streaming.

This also can be traded, bought and sold, even held as a stake which increases the demand and creates inflation. More convenient to transact without the involvement of third parties. The network is so secure that it's immutable, while all transactions are recorded and open for all to access. Moreover, the token functionality is automated through a set of rules and can be provided with additional capabilities and functionality which brings multiple revenue streaming opportunities eventually.

If you are wondering how this is all even possible, Blockchain does it effortlessly. Compared with modern requirements, traditional real estate investment is more centralized, involving hefty procedures and geographic and regulatory constraints. While digitized real estate tokenization through blockchain has simplified most of these investment barriers and enhanced accessibility and transparency.

Role Of Blockchain In Real Estate Tokenization

Blockchain technology centers as the heart of real estate tokenization, this is the backbone driving the growth of investment opportunities in decentralized space moving with efficient transaction management. Blockchain technology is a decentralized network that has blocks chained together and the transaction is recorded in distributed ledger format, the records are shared, accessible, and transparent, yet they cannot be altered and manipulated. It's ensured to be tamper-proof and highly secured with compatibility and efficiency, making it a vital choice for real estate tokenization.

Through smart contracts which are a set of rules that define individual aspects of the blockchain ecosystem and rules and regulations to follow, the tokens are backed by these contracts to make it automatic. These self-executing contracts suggest the terms and conditions of the asset it paves the way to seamless transactions in terms of selling, buying, trading, and staking the asset. The process of minting (creating the token) and burning (demolishing the token) are simpler, cut down the human error, and enhance the quality of the token, and its transaction efficiency.

These assets provide ownership rights through blockchain, while the inheritance is keenly tracked. Eventually, as there are different token standards for asset tokenization, Real estate with the ability to be fractionalized, ERC-721 is commonly used on the Ethereum network. This keeps the role of the token intact and it is uniquely crafted to meet the augments of traceability and security on the transaction.

Understanding the Process of Real Estate Tokenization

The working process of Real Estate Tokenization is very similar to any other crowdfunding model. The underlying real estate asset can be fractionalized into minor bits while digitizing them as tokens. These small fractionalized assets using smart contracts automate the process on the blockchain. The investor who purchases the asset is entitled to own the underlying asset that is associated with the token and adhere to the profits and losses equally.

Real estate tokenization can be either a commercial property, residential asset, trophy, etc. large-scale commercial properties like malls, complexes, apartments, big monuments, anything can be tokenized, and also can be fragmented into smaller units, - therefore making it an affordable choice of investment. This facilitates quick and easy sales, as well as purchases. Rough tokenization of illiquid assets can be liquidized very seamlessly making it an easy way to raise funds for projects.

The other category of tokenized real estate is Trophy assets, these are properties with great demand in the market. Which includes iconic places, landmarks, buildings, vineyards, riverbanks, and anything that has a great value and reputation for its production in that wide area would be an eligible option to tokenize as trophy assets. Through the process of tokenization, the ability to create promotion and split the deeds among holders as equity entitled to legal regulations, the ownership aspect is collateralized.

Here we have categorized a few real estate asset tokenization.

1. Simple Real Estate Tokens

Representing a simple Real estate property as a single real estate token as NFTs.

2. Dynamic Real Estate Tokens

Assets are being enhanced as dynamic NFTs that are automatically updated by the database based on relevant conditions.

3. Fractionalized Real Estate

One of the compelling use cases, that enable fractionalized asset ownership, operating on fungible tokens.

4. Tokenized Real Estate Cash Flow

Possible to tokenize separately and form a particular cash flow through the tokenized Property.

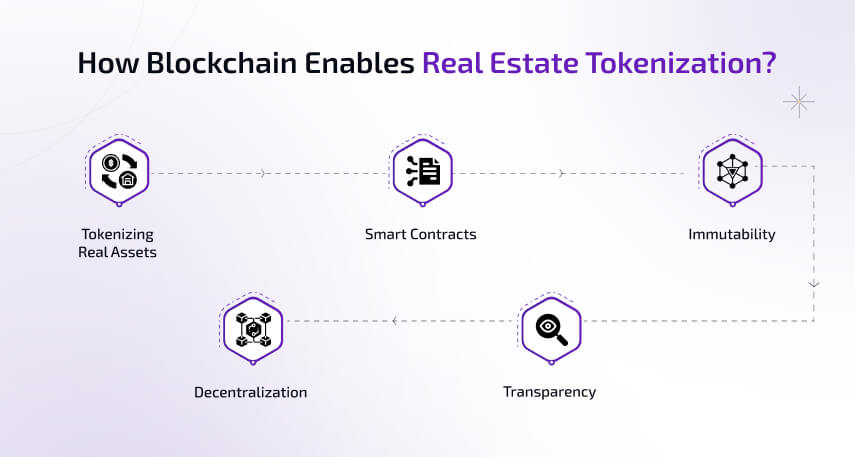

How Blockchain Enables Real Estate Tokenization?

Blockchain technology is the foundation on which the entire infrastructure of real estate tokenization is, here is how Blockchain enables Real Estate tokens.

Tokenizing Real Assets

Real estate tokens are Real estate assets converted into digital tokens on the blockchain network. They also represent fractionalized ownership of the asset that is underlying the token.

Smart Contracts

Automated contracts on blockchain that can govern the terms of ownership, rental payments, and other aspects of real estate transactions.

Immutability

The blockchain's immutable nature is the highlight which ensures that all transactions and ownership records are securely stored on the network, and cannot be altered.

Transparency

Blockchain with its transparent nature allows asset management to a more authentic manner where ownership, rental payments, and property management are easily tracked.

Decentralization

Blockchain eliminates the need for middlemen or any intermediaries in the process, especially avoiding real estate agents, which reduces the costs incurred and increases efficiency.

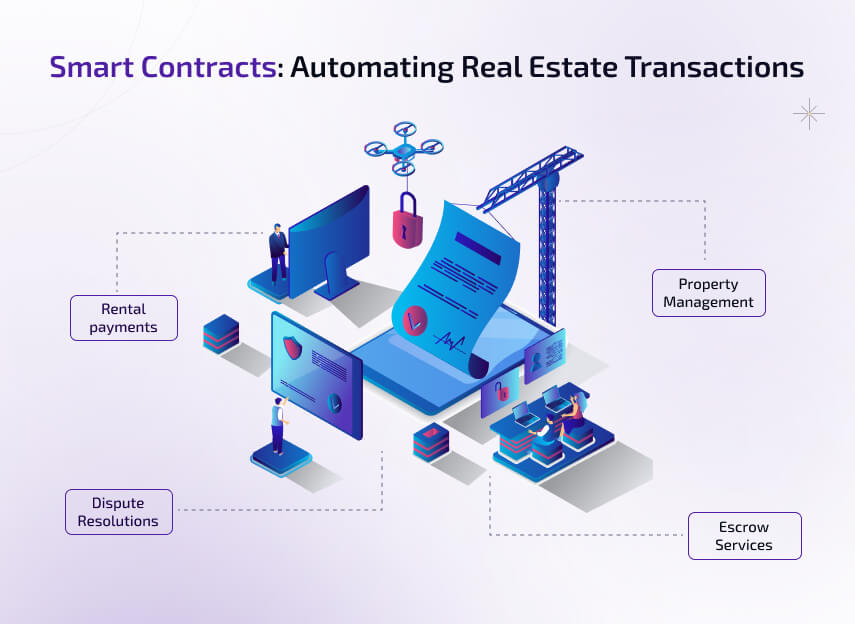

Smart Contracts: Automating Real Estate Transactions

Smart contracts are self Executing contracts which are directly coded on the assets token. They are deployed on the blockchain network to automatically perform the pre-defined task meeting the conditions. The smart contracts of real estate tokens execute various processes like

1. Rental payments

The contract automatically collects and distributes rental income for the token holders.

2. Property Management

As they automate tasks, the maintenance aspects can be scheduled and communicated effectively to the tenants.

3. Escrow Services

To hold funds until escrow is also possible to do with smart contract development on real estate, which can also ensure security while transferring.

4. Dispute Resolutions

They provide automated resolutions for disputes through their resolution mechanism by smart contracts.

Security And Transparency In Tokenized Real Estate

When compared to any new technology, Blockchain can be secured, strong, and transparent when designed efficiently to meet effective needs.

Immutability

The transactions are recorded on the blockchain in a distributed ledger format, which can not be altered.

Transparency

All the transactions, ownership details, and records are very transparent and easy to manage, publicly visible, and takes accountability for the records.

Security Audits

They are audited smart contracts, that can address potential risks and vulnerabilities, identify threats, and provide potential resolutions.

Consortium Blockchain

Through this network, sensitive data are provided with additional layers of privacy, security, and control.

Technology

Real estate tokenization blockchain technology provides improved efficiencies, transparency, and accessibility.

Key Blockchain Platforms For Real Estate Tokenization

Ethereum, Tezos, Binance Smart Chain, Polkadot, Solana, etc., are different blockchain networks that support Real Estate tokenization, and these are the most commonly used networks in 2024. They have their own benefiting nature with the feature trait they carry for themself.

Listed below are a few other Real Estate tokenization platforms that are being used in 2024.

1. ConsenSys

Strong staking tool, with great staking benefits, ConsenSys. It's beneficial in terms of asset token support, convenience to make changes, and more. The current focus is to collaborate with other blockchain networks making it more flexible and independent for dapps.

2. Toko Network

The Toko network offers different types of tokenization and has a very user-friendly interface. It is bound by strict security norms and it opens tokenized intellectual property, real estate art, etc. And their encryptions are strong with good storage options for data and assets.

3. PixelPlex

They make unique software solutions and support different businesses, mainly focusing on solutions to replace older systems. The platform ensures high protection and affords good security alongside being transparent.

4. Securitize

Securitize being experts in tokenization, they ensure to follow the rules and provide transferring service that make assets into tokens. They are very secure in terms of swapping tokens following legal regulations.

5. Vertalo

A digital transfer agent with a tool helps the buyers get access to tokenized assets in great shape. They also focus on getting the investors onboarded on the platform and ensuring they stay longer and intact.

6. Polymath

Polymath focuses on issuing secured tokens and providing them with business tool kits to overcome the difficulties in legal compliance seamlessly. The contracts on the platform contribute to the feature changes, security, and transparency aspects of the business.

Is Tokenized Real Estate Worth It?

Through Tokenization, the asset gets a sense of more connection and accessibility with the external world in more security, and transparency. The ability to bring liquidity for illiquid assets is also another key point that Real estate tokenization brings to the table. Through tokenization, the information and data obtained are more lucid and easy to track while with physical assets the process is hefty with a lot of middlemen and

1. The market condition of the real estate market underlies the property that can significantly have a great impact on the value of the tokenized asset.

2. The tokenized platform that is used to tokenize will influence the liquidity, fee, and security of the asset.

3. The value of appreciation is determined by the underlying real estate asset of the token.

4. The environmental regulations placed around the asset as the governing framework of the token also have a great impact in terms of legality, attracting investors.

Advantages Enjoyed By The Investors And Property Owners

Real Estate Tokenization being a revolutionary sector brought in great investment opportunities for investors across different landscapes, which has also benefited but overcoming traditional investment inefficiencies while bringing new market avenues. Eventually, as real estate tokens have made investment more accessible, it brings liquidity and other advantages which are discussed below.

1. Asset Fractionalization and Accessibility

Before the invasion of Real-world asset tokenization development, the opportunity to access for many investors was denied as there were high financial barriers and constraints. But with fractionalised tokenization, they made real estate investments more accessible and easy for a wider set of audience. This also provided the investors an easy way to enter and travel in the real estate investment with a distinct investment portfolio that is flexible to own any number of fractionalized assets.

2. Improved Liquidity

One of the effective phenomena that real-world asset tokenization brought in is increased liquidity brought into the real estate market. Here as the process of physical properties converted into physical assets on the blockchain, the underlying asset can be brought in like live stocks and other securities. This enables quick transactions, and wider investment opportunities that made modern investments popular over traditional investments.

3. Increasing Efficiency Cutting down Cost

In the process of streamlining and removing the traditional middleman concept, tokenization of real estate assets on blockchain significantly has the potential to cut down the operational cost and improve the efficiency of the platform on the whole. Avoiding brokers the time and cost is merely cut down while smart contracts with the ability to automate transactions, and secure the process can enhance and reduce the errors and disputes.

4. Small scale Investments

Real Estate is a large-scale investment in general, while it is for elites only, and the investment basics are bigger, through tokenization this barricade is completely removed. Inviting small-scale investors to come in and contribute. This has completely changed the game making small-scale investors contribute with real estate tokenization which is fractionalized, which is affordable, and more accessible.

5. Flowing market

The centralized system is over-regulated, with no assurance of security and transparency. It's biased and makes the flow very detrimental in the market. Through blockchain, real estate tokenization is introduced as a decentralized finance instrument that provides the stakeholders the power of authority and can make decisions. This eliminates discrepancy, streamlines the market, and provides equal opportunity for all.

6. Minimal counter-party access.

It is hard to track long transactions, while blockchain in the tokenization era, brought in an immutable system in distributed ledger format that can track the entire process seamlessly. The integral smart contracts make things better in terms of the regulatory aspect of the tokenization.

With a minimum human intervention in the space, the chain of transactions is short which eliminates the inherent risks that are intact with weak links. This risk of counterparty involvement has become more significant, while not eliminated.

Challenges To Consider In Real Estate Tokenization

Real estate tokenization offers different benefits and advantages, but there are a few limitations and challenges that have to be adhered to. By ensuring to overcome these challenges that would venture you into a better investment space.

Regulations and Legal Considerations

Navigating legal and regulatory landscapes is a significant challenge in real estate tokenization. The frameworks in terms of legal norms vary according to the governance. In the evolving state, it is a bit tricky to meet the considerations on a precise note.

Volatility and Market risks

In terms of investments, market risks and volatility are inherent. And there is no exception. As blockchain technology offers a level of security, the market often is highly volatile which affects the stability and prediction around the investments made.

Cybersecurity concerns and Technical challenges

Technical challenges and cybersecurity concerns are an important aspect of real estate tokenization. The reliance is robust and secured on blockchain technology while the IT infrastructure is also essential. To be protective against cyber threats and ensure the integrity of the blockchain, which adds up to managing and maintaining investors' trust and the safety of assets. Through continuous vigilance, risk mitigation is easy.

Smart contract security loopholes

The blockchain network is secured, but smart contracts have loopholes that must be plugged in. To keep your platform, contract, and token secured, diligent auditing is mandatory. Or you bear the risk entirely and the recovery is still not sure.

Licensing requirements

Real estate assets need a properly licensed platform to operate and manage. The Security token offering platforms have to be well regulated and they must meet the goals which are non-negotiable. In the process of hitting it, licensing can be complex, but undergoing multiple trial phases would be a simple thing leading to success.

Taxation complexities

Most of the tax regimes do not have cryptocurrency tax regulations which is the start for all the problems among stakeholders. Despite the advancement of tokenization, through sound taxation policies, it would be well regulated and lack of it would lead to a lot of confusion around adaptation.

The Future Of Real Estate Tokenization

Real Estate tokenization is observed to be more than a passing trend, having a great influence over the prevailing investment opportunities. They are on the verge of redefining property investment ownership. This evolving landscape with specialized roles, expertise, and advanced technological solutions gearing to be paramount in the sector.

With such a great market opportunity, we at BlockchainX are utilizing the impact of technology advances and opportunities are nurturing our expertise for different sectors. We intend to create the digital revolution and be at the forefront of the emerging trends. With experience and indulgence, we take up blockchain-based projects with the intent to showcase our ability in multiplied metrics. We provide a variety of blockchain-based services from token development to developing a complete ecosystem including decentralized applications, exchanges, Platforms, marketplace, complete blockchain networks, etc. Our intricate smart contacts are designed to meet and automate the desired functions seamlessly. Therefore contributing the best for Real estate tokenization and any other services for that matter.

We provide you with a complete panel guide, from consultation to development, including strategic planning technical support, and navigating solutions over complexities, that would benefit any investor who is looking to explore the potential of Real estate tokenization on blockchain. As the complete concept of buying and selling is unwinded with asset tokenizations on the blockchain, there is a larger scope for exploration eventually.

The market reports also suggest that from $2.7 billion in 2022, the growth is going to be exponential in a decade with over 10 times what the current value is. Real estate tokenization brings a new spectrum for owning properties. Almost all the states including Japan, Singapore, the UK, the European Union, etc., are exploring this new investment venture. As rules like market stability, protecting inflation and deflation, and enacting buyers and sellers, the traction is high.

Despite a few constraints in real estate tokenization, the more open it is to explore, the future of the sector is bright with multifold opportunities. Bringing stability, scalability, meeting market norms, and regulations, handling market volatility and complexities the sector continues to nurture and so your participation. With improved blockchain technology these institutes are inherited to meet real estate investment requirements easily, appeal to, and bring a wider audience.

Conclusion

Tokenization of real estate assets on blockchain have been a mulling topic in the sector, and obviously with a growing traction, high returning appreciation. With Blockchain, we provide customized services catering your needs adhering to advanced blockchain technology and meeting its regulations. Our experienced team has relevant experience and is open to learning new advancement. With that, now it's all your call to make the right choice that would lead towards growth and progress.

prev

next