Table of Contents

How Blockchain Technology Transforms Crowdfunding

Blockchain technology is transforming everything around us, and it is no exception. Currently, 40 million people, or around 0.5% of the world's population, use blockchain technology. This technology can be utilized to improve businesses because it is secure, fast, and transparent. Blockchain is officially trending in this industry as it is widely used in crowdfunding app development. This comprehensive article combines our expertise to present an in-depth analysis of the potential of blockchain-based crowdfunding as a groundbreaking business idea and the pros and cons of crowdfunding.

Blockchain-Based Crowdfunding: Explaining The Terms

Let's define some terminology before discussing how blockchain technology could improve crowdfunding in particular. Crowdfunding is a specialized field, and blockchain may be confusing at times, so let's make sure we're all on the same page.

Crowdfunding is a platform for startups to raise funds. They differ in type, but the most popular are Peer-to-Peer, Rewards, Donations, and Equity.

Peer-to-Peer lending is sometimes known as debt crowdfunding. It assures that investors profit from a business in which they invest within a specific time period.

The Rewards Investors in crowdfunding typically profit immediately by receiving some type of reward for the money they put into the concept. The value of the reward may differ from the size of the donation, which encourages people to donate more money.

Donation - based crowdfunding apps enable investors to financially support a company without expecting anything in return.

The Equity funding type is asset-based. Each investor receives an asset and becomes a co-owner of the startup in which they invest. It is the best method of fundraising for crowdfunding apps that use blockchain.

Crowdfunding Script

A pre-made software solution known as a crowdfunding script enables people or organizations to design and launch their crowdfunding platforms. We create these scripts to simplify the process of raising funds for personal needs, social causes, startups and projects. Platform owners can provide features like project creation, donations, payment gateway integration, user registration and more by utilizing a crowdfunding script rather than starting from scratch with the systems development.

How can Blockchain increase the efficiency of Crowdfunding platforms?

Blockchain technology is one approach to drastically improving the customer experience through crowdfunding initiatives. This technology makes the workflow of any project that includes money transactions more transparent, simple, and rapid.

Blockchain and crowdfunding can be ideal partners to transform fundraising for so many creators.

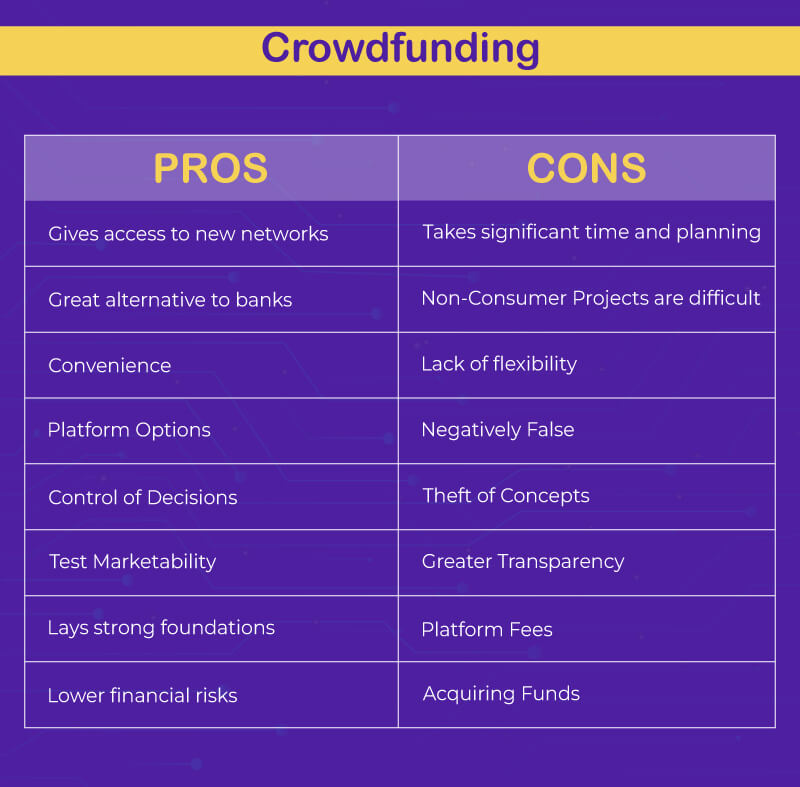

Advantages of Crowdfunding

1. Convenience

The first pros of crowdfunding are a convenience. The launch of a crowdfunding campaign is not restricted by timing or location, allowing for flexibility and accessibility. Additionally, the platforms offer direct access to a fast-growing community eager to support new ventures. This significantly reduces the amount of research typically needed to attract investors or supporters. Now, this is not simple; it's just more convenient.

2. Great alternative to banks

Crowdfunding is a great alternative to the conventional approach of borrowing from banks. It's no secret that securing bank loans for SMBs and startups may be difficult. They pose a risk that many traditional banks are hesitant to incur. Even if you succeed in getting a loan, it is unlikely to be on favourable terms. Unlike banks, crowdfunding campaigns provide a range of donation options, along with interest-free loans and alternative funding methods.

3. Platform Options

Crowdfunding platforms are becoming increasingly popular due to their growing popularity and online accessibility. As with most things in life, the greater the demand, the greater the supply. As a result, various crowdfunding platforms have expanded and specialized in specific industries. This means that businesses can select from a variety of platforms with varying specializations, prices, incentives, and communities.

4. Control of Decisions

Traditional funding methods, such as partnering with venture capital firms or angel investors, often result in entrepreneurs giving up control over key business decisions. Contrarily, crowdfunding is distinct. Owners of businesses are not obligated to give up their rights. Entrepreneurs still hold the reins in spite of their desire to listen to their supporters.

5. Test Marketability

One of the most significant pros of crowdfunding is the ability to assess the marketability of a concept. The whole system operates by attracting numerous individuals to dedicate their time, evaluate an idea, and ultimately make a financial investment. There is a good chance that the business idea or model will flourish on a much larger scale if finance is obtained within the specified period. It's a fantastic opportunity to evaluate its performance before the official launch.

6. Gives access to new networks

Although crowdfunding platforms don't actively seek out private investors for you, they do provide you with access to a strong community of supporters. Additionally, campaigns that are actively financed typically garner a lot of attention. Featured newsletters reach not just investors but also social media, trade media, and, with luck, national media. This helps your crowdfunding effort reach a wider audience.

7. Lays strong foundations

A successful crowdfunding campaign will help you lay the foundation for any future ventures you have in mind. The SMB accounting company raised more than £2.4 million in its most recent crowdfund, exceeding its aim by 350%. This was largely due to the success of a previous crowdfunding campaign, which took place in 2022. Entrepreneurs will find it easier to gain momentum if they create a network of active supporters before seeking future investment.

8. Lower financial risks

Another pros of crowdfunding is that it allows business owners to explore without risking their money. As previously stated, the funding process helps evaluate market interest. If it becomes evident that there is none, entrepreneurs can cut their investments in inventory, marketing, new personnel, and so on until any underlying difficulties are resolved.

Disadvantages of Crowdfunding

Every coin has two sides that is Crowdfunding advantages and disadvantages are no exception. Before deciding whether crowdfunding is a suitable choice for you, check out our list of disadvantages.

1. Lack of flexibility

A Cons of crowdfunding is the inability to change a campaign once it has been launched. This means that the description, terms and conditions, and completion time cannot be amended. If entrepreneurs are compelled to make changes to the campaign, the project may be declared null and void, and investors may be required to receive a refund. So, before you begin, ensure that you are completely aware of all parts of the project.

2. Negatively False

Another typical issue with crowdfunded initiatives is reaching assumptions based on false-negative results. This is especially true when it comes to idea validation. Entrepreneurs, for example, may incorrectly infer that the project failed because the product did not meet market demand. However, its failure was primarily due to bad marketing and a misunderstanding of what the product did. It does fill a market need, but it could be "marketed" better.

3. Takes significant time and planning

Many entrepreneurs underestimate the time, work, and organization required for a successful crowdfunding campaign. Regular investor contact, detailed financial reports, Predictions, the POA (the plan of action) for invested funds, and so on. this is all standard operating procedure (SOP), and a strategy must be implemented (and documented) prior to the start of a campaign. Otherwise, entrepreneurs risk alienating their community and appearing unprofessional and unprepared.

4. Theft of Concepts

Idea theft is arguably the most serious drawback of publicly crowdfunded initiatives. Entrepreneurs are especially susceptible to fraudsters coming in and stealing their ideas before selling them to other investors or organizations. This is due primarily to a lack of awareness about how to protect their intellectual property as well as a lack of money to adequately defend it in court.

5. Non-Consumer Projects are difficult

Crowdfunding campaigns are currently largely effective in the B2C (business-to-consumer) industry. It is unusual to see the same level of success in B2B (business-to-business) ventures. This is due primarily to the investment community. They can easily identify with a product that has a clear, real influence on consumers.

6. Greater Transparency

A Cons of crowdfunding is higher transparency; not everyone is eager to make financial and other critical information public. However, if an entrepreneur wishes to seek funds through one of these platforms, investors will require access to this information in order to make educated selections. This isn't for everyone, so consider twice before launching a campaign.

7. Platform Fees

Every platform that facilitates crowdfunding deducts a portion of your total investment. For instance, both Crowdcube and Kickstarter take a 5% cut. A 3-5% payment processing fee, as well as 3% plus $0.20 for each pledge, are additional costs. Before choosing a crowdfunding platform, be sure to consider all hidden fees, including those paid by credit card companies.

8. Acquiring Funds

A Cons of crowdfunding campaigns is that you must wait until the time limit is reached before collecting the donations. This may take anything between 60 and 90 days, depending on the length of the campaign, so it's absolutely worth considering.

How Blockchain Helps Crowdfunding to fix its drawbacks

Blockchain technology has had a significant impact on the crowdfunding market, and its potential is genuinely limitless. So, let's have a look at how blockchain helps crowdfunding fix its drawbacks.

Decentralization

The primary feature of blockchain is its decentralized nature. It has an impact on crowdfunding initiatives by reducing processing fees. Since blockchain removes the need for intermediaries or third parties in financial transactions, it has the potential to make crowdfunding far more affordable for creators.

There's also a chance that, with a decentralized network like the blockchain, crowdfunding will have fewer restrictions. Before launching a campaign, a startup must first establish an audience. Blockchain-based crowdfunding platforms may allow creators to begin raising funds not just on one platform but on several, resulting in successful combinations. B2B companies, or those that generate services rather than products, will have great potential for exposure with the use of blockchain.

Tokenization

Tokenization has the potential to significantly improve equity crowdfunding. Tokens allow investors to own a share of the project they are funding. Let's take a closer look at the benefits of crowdfunding app development.

1. Greater exposure to more successful projects

2. Increased hiring expenses

3. Transparency and security

Smart Contracts

To begin with, smart contracts will allow individuals to identify both sides of a transaction, reducing the chance of fraud. Smart contracts are also significantly faster than usual fund transfers since they do not involve the use of intermediaries. When deadlines are approaching, more speed can be beneficial. As smart contracts facilitate increased transparency in communication between investors and startups, crowdfunding projects enabled by blockchain technology are poised to achieve higher efficiency.

Blockchain technology opens up new possibilities for enhancing intellectual property security. Smart contracts will not allow third parties to obtain unauthorised information about the idea, project budget, or execution plans.

Final thoughts

As technology continues to evolve and regulations become clearer, blockchain-based crowdfunding has the potential to reshape the crowdfunding landscape and provide new opportunities for entrepreneurs and backers alike. Crowdfunding advantages and disadvantages are very helpful in deciding whether crowdfunding is for you or not.

We hope you found this article informative, and if you have any views or ideas to share, please do!