Best DeFi Platforms To Look Up Before 2023

Decentralization in recent years brought in revolutionizing transformation in the ecosystem. Decentralized finances have a primary role to play here. Today, they have been raised to be an unaltered structure in the space of decentralization and finances. Defi platforms have been the rise to new functional structures as well. But there are lows and highs here. To choose the Best DeFi Platform in 2023 is important to get your projects listed and yield your requirement without any collapses. Let's get straight into the world of DeFi platforms, a transparent ecosystem crafted to support creative entities in the era of decentralized supremacy.

What Are Decentralized Finances And DeFi Platforms?

Decentralized Finances are financial instruments that act upon their own. Going by their name, they do not involve any intermediator in the process and it's governed by its own using smart contracts. Eliminating the needs of brokerage, banks, and exchanges this self-contained operating ecosystem allows users to yield their investments.

The Defi Platform, unlike bringing users and facilitating as a financial structure, this lending platform connects investors and project holders together. Being the bridge, it satisfies the user's needs mutually. The projects need investments to progress and develop to the next phase, and men, while the investors look out for the right object to invest in, shall be convenient. These Defi platforms are community-oriented, precisely authenticated by DAO, and it's open to the voting system on the governing token for its governance.

Checklist To Consider On An DeFi Lending Platform

Before getting a project listed or entering in a Defi platform As an investor, there are few checklists that are to be considered in order to proceed on an ideal platform that benefits best.

Choosing a Defi crypto Platform is like choosing a financial platform that obviously demands few expectations to be fulfilled. Listed below are key factors to consider before choosing the best DeFi platform to land.

Fees

Like every other platform, Defi Platforms also charge fees for their services that are fluctuating based on market propositions. Therefore checking the various prices that are scheduled for specific services is important.

Services

Every platform differs from others, not just externally, but also in various other aspects. The functionalities and services alter differently. Check on the platform if it facilitates your required decentralized services.

Crypto available

DeFi platforms are also used to trade, steak and exchange. In that case, if you want tradin as a part, then check on the different available coins listed in the platform. This eases the process beforehand.

Mode of payment

Wallet connections are common and necessary for depositing and transferring cryptos. There are fiat exchanges also available with an added fee. To check on the mode of payment and its fees could give a clear idea.

Security

Decentralization is all about safety in transparency. But to be secure it is also important to be away from the hack and other malicious attacks. Scrutinizing the security norms is a good way to go.

Wallet supports

As mentioned the Defi platform performs various tasks and the wallet is a must to ease them. But not all platforms support all wallets. To know if your crypto wallet could support the platform or not.

List Of #10 Best DeFi Platforms To Consider Before 2023

1. Aave (Lend)

Aave is an Ethereum-based protocol, that is open source and noncustodial allowing its user to make huge returns. It's used to borrow and lend crypto along with its other services. The ERC-20 token was given to lenders to make compound interest, and LEND is their governing token. Alongside it also gives other services like loans, and flash loans. Rate switching, collateral, etc.

2. Anchor Protocol

The TERRA-based application allows users to earn interest on their deposits of their stablecoin TerraUSD. This is one of the relatively new protocols in compromise to others. In addition, the 20% discount on the deposit rate made Anchor Protocol sound more familiar. This integrated payment has achieved good responses in the community as well as among borrowers. The newly introduced dynamic interest rate is a sustainable approach.

3. Coinbase

Coinbase is well known for the exchange services it renders for purchasing and Selling bitcoins. It also operates Litecoin and Ethereum exchanges and presents a wider variety of altcoins through its simple user interface. It facilitates instant transfers, well-documented API, wallet Services, and protections.

4. Compound

An openly available platform that is homed at the Ethereum blockchain. The Compound allows its users to lock their assets in the protocol, let it be the sender or buyer in that case. It also allows users to tokenize their assets that are locked in their system. With tokenization, the users are allowed to trade assets they lock in the platform.

5. Curve Finance

Curve operates on Ethereum, an automated Market maker, a decentralized exchange that has a prime emphasis on swapping. It supports yield-bearing tokens for individuals to participate and get gas/ swap fees by the curve pool. It has a comparatively lower trading fee, and minimum slippage and allows direct token trade with better yielding opportunities.

6. Dharma Protocol

A tokenized, decentralized platform for funding and debts for lenders to borrow. They can trade and transact with one another. The Dharma Settlement Contracts are used by the system, a traditional financial instrument, and stakeholders. Underwriters, Relayers, borrowers, and lenders are the four major operators of the platform.

7. Hifi

A formal mainframe on the Polygon network offers stablecoin deposits with returns. There are options to Create a fungible token or those that are bonded and settled on a specific date. It also has a cross-function bridge allowing used tokens from another blockchain for collateral and deposit. The MFT is the governance token of Hifi finance.

8. InstaDApp

A multi-purpose Defi platform that manages digital Assets. It is used to provide a variety of DeFi services from lending to swapping. Meeting its user's needs, and providing services are considered a DeFi bank. Users switch easily to lower interest rates on cheaper lending platforms through here.

9. Maker

The Maker protocol is a multi-collateral Dai and is a trusted Defi lending and borrowing network. It avoids the volatility of the cryptocurrency market. DAI is the stablecoin is tied with dollars that makes smart contract terms borrowable. This open-source protocol is based on Ethereum allowing users with ETH and metamask easy functionality.

10. Uniswap

This platform is backed by the decentralized network protocol, Uniswap is a popular DeFi platform with the strength of automated transactions among cryptocurrency tokens on the Ethereum network. In addition, it offers additional power to DeFi developers in protocol documentation and guides them through and this is a completely open-source code with yielding farming opportunities, and high resistance for censorship.

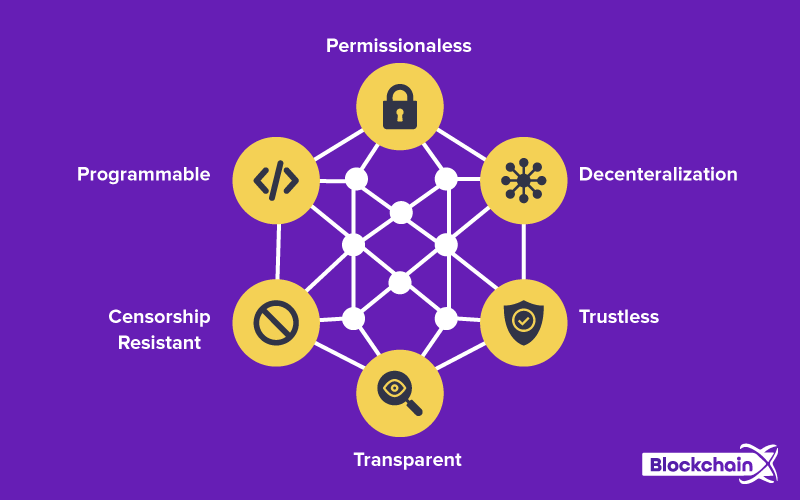

True potential expected in Defi platform development

The Defi crypto platforms give users the freedom to carry out transactions and settle their financial issues through decentralized protocols that are supported by smart contracts. Eliminating banks and other centralized intermediaries, Defi facilitates its users - a collective of buyers, sellers, investors, and lenders to connect seamlessly giving permission to make direct borrowing and save lump sum capital in a highly secured and safe manner. Moreover, the best Defi platform facilitates its user with

1. High Transparency

2. Completely Decentralized

3. Permissionless Solution

4. Total Privacy

5. InteroperbleNature

6. Secured and Safe

Apart from these, a Defi Platform renders various services including token listing, Exchanges, staking, trading, connecting investors, lending crypto, and more. Its plethora of services helps its users to concentrate on different verticals at a stretch, as it fulfills diverse industry needs.

Best Defi Platform - Meet The standards In Your Style

With an extended outrage in the global market, The decentralized finances and DeFi platform are widely getting popular with its extensive use cases and extensive functionalities. With all that in a row, DeFi is one of the finest sources to pull in revenue in terms of investments. And have you not given a thought of taking your standing in this lucrative body? Reaching out to a blockchain developer rendering Blockchain development services can help you get your desired crypto DeFi Platform developed at ease.