What Is ISO 20022 : How Will This New Data Standard Impact Your Crypto Industry?

08 DEC, 2022We all understand this rampant blockchain well, don't we? What is blockchain and why? What are its main components? What are NFTs in Blockchain? Their usage is like etc. Still, here is a summary for those who don't know about all this stuff.

NFTs (Non-Fungible Tokens) are unique cryptographic tokens that exist on a blockchain network and cannot be replicated. NFTs can represent real-world items such as artwork and real estate or a video. "Tokenizing" these real-world tangible assets makes buying, selling, and trading more efficient while reducing the likelihood of fraud.

We hope that by now you have some basic understanding of NFTs. Here we detail what is NFT staking and how to earn money from NFts. Without further ado let's get to our topic.

These tokenized NFTs can be staked and managed securely on NFTs staking platforms like Binance NFT power station, MOBOX, etc. The word staking hits our mind with rewards and returns. It's right in the case of NFT staking. Staking your Non-Fungible Tokens (NFTs) is a viable option for building cryptocurrency in modern times. NFT holders have more opportunities for gains by investing in NFT staking platforms. This raises the value of NFTs today.

Many of us think of earning money without losing energy, there are many ways. Passive income through the bank is one of the wealthy options. If you receive hardly any interest on your money in the bank, even you have to pay for your savings. As investing in cryptocurrencies and NFTs has relatively high rewards, a new-age alternative has been discovered.

What is NFT Staking?

The advantage is not only in buying NFTs but also in making money by staking them instead. NFTs work on blockchain by staking your unique tokens. In short, NFT staking means attaching your non-fungible tokens to a platform or protocol. In exchange for this activity, you will receive staking rewards. This way, you can earn extra while you continue to be the owner of the NFT.

We can compare DeFi yield farming with NFT staking, both of which are almost the same methods. DeFi yield farming deploys liquidity to providers in exchange for benefits in the form of cryptocurrency loans or interest or reimbursement of transaction fees. It is like the passive income you can earn from a bank but without the bank. Compared to the centralized banking system, NFT stacking is more prevalent in the decentralized sector of finance.

How does NFT staking work?

NFT staking works similarly to staking cryptocurrencies as NFTs are tokenized assets. Also, for NFTs, not all non-fungible tokens can be staked, just as all tokens can. Since NFTas are tokenized assets, you can deploy them on NFT staking platforms where you can keep them safe. This is possible through a smart contract on the appropriate blockchain protocol.

NFTs are creating a new wave in the blockchain world. Staking NFTs is a new concept, but it has generated a lot of enthusiasm among NFT holders. This is because the unique nature of a non-fungible token makes its owners reluctant to part with it. The main difference is that buying and selling cryptocurrency is very simple. But stacking is somewhat different.

Here are three major points that you have ping in your mind while staking with NFTs.

1. First, you need a crypto wallet suitable for your NFTs.

2. Check the wallet fits the blockchain on which the NFT is located.

3. Connect the wallet to the staking platform and send your NFTs for staking.

A cryptocurrency wallet compatible with the NFT you want to stake is essential. Before attempting to access NFT, you must ensure that your chosen wallet is supportive/flexible with the blockchain platform. After that, you can transfer your NFTs to the staking platform by linking your wallet to the service. You can connect this process as "staking" your crypto coins.

Staking rewards for NFTs

If you ask what kind of staking rewards an NFT holder gets, the answer is it depends on the blockchain platform used for staking and the type of NFT. Most NFT staking platforms offer periodic rewards i.e, daily and weekly payments. Most often, these rewards are paid in the platform's utility token, but there are exceptions. Regardless of the tokens used to collect rewards, you can trade staking reward tokens and convert them to other cryptocurrencies or fiat money.

Here we are going to add some salt and pepper to the NFT holders, that's DAOs (Decentralized Autonomous Organizations). These are staking platforms where the NFT holder can lock their assets into a DAO pool, also known as an NFT staking pool. The highlight of DAOs allows NFT holders to participate in governance tasks on the platform. This often includes voting rights when proposals are made.

Another interesting way to earn staking rewards is through blockchain games. Yup, probably most of the NFT on the NFT market belong to various blockchain games, there are also various staking opportunities in play-to-earn games like The Sandbox, Axie infinity, Splinderlands, etc.

The main advantage of play-to-earn games is that you can earn not only cryptocurrencies but also NFTs. This is a double benefit, which means, it makes it possible to earn NFTs for free and then stake them.

How to earn passive income by staking NFTs?

If you have NFTs in your crypto wallet, you can use them to earn passive income. NFT staking is the newest way to generate passive income using blockchain technology. As with any such source of income, you must invest upfront. In other words, passive income through NFTs is primarily earned through cash investments.

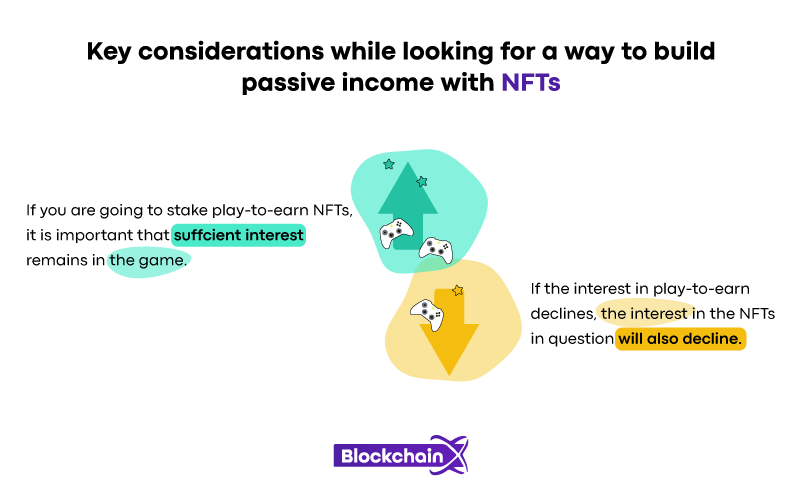

The popularity of a game can also increase, allowing you to earn from the NFT, itself. It is, therefore, important to do proper research on the NFT as well as on the market, the utility, and the staking rewards.

What are the top NFTs to stake?

Think you should stack your NFTs? So make sure what you are aiming for. To find the best NFTs for staking, you need to know where the opportunities are. So good market research is very important for this firm. There are different NFTs that you can invest in, each of which has its characteristics. So, make sure your strategy is clear to you.

Are you a gamer? Or interested in investing in this industry? For example, an NFT staking platform like Splinterlands is an interesting option for you. Built on the Ethereum blockchain, this play-to-earn game allows players to earn extra income through NFT staking. Always remember that NFTs can downgrades in value, so holding your non-fungible token involves risk.