Precious Metal Tokenization - Complete Guide On Transformative Investments

19 September 2024However, this 21st century is all about crypto tokens, blockchain, and its relatives, the hype that real-world asset tokenization gained in the past couple of years signifies tremendous growth. From a basic art piece to tokenizing a collection of rare items, real estate, machinery, monuments, and more, the new buzz over Precious Metal tokenization is creating viral opportunities for all.

Web3 has been a constant trendsetter from the very beginning of its arrival in the market. Among these tokenization started a new economic revolution introducing substantial crypto tokens for USD. The movement now has expanded to tokenize anything and everything.

Tokenization is a process of bringing a digital identity for assets and creatives in the digital space that is backed by blockchain-powered smart contracts. When we say precious metal tokenization, the process involves converting real metal worth digital representations as tokens on blockchain networks. Through this, the metal supply, market value, investment opportunities, and many more aspects exponentially can be tracked, and traced along with precise data extraction are made accountable. Tokenization industries like supply management, logistics, resource management, and more have been highly beneficial in one certain aspect which is Immutable data records, that show the outstanding balances while providing clarity on its versatile transactions blockchains transparency and authority over the asset are all digitized, which reduced the more accurately and precisely. Eventually let us unleash the potential of Precious Metal Tokenization, benefiting multiple sectors, that also opens up a larger investor pool.What is Precious Metals tokenization?

Precious metals include Gold, silver, platinum, nickel, bronze, and any other metal with a good market value.

The tokenization process is a way of representing assets in the digital form on the blockchain, whose ownership can be represented, traded, stored, and transferred. As these tokens represent ownership for a certain quantity of tokens, where the token holder gains the ownership of the physical asset along with the digital token.

Through Blockchain advancements, from token initiation to the current status of the token can be traced, traced, and stays unaltered in the distributed ledgers, where transaction safety and transparency are achieved. Therefore giving complete assurance for investors to make fearless investments, which would bring actual returns. Eventually, this also adds up to the profile of the investor mentioning diverse investments made.

Traditional Precious Metals vs Tokenized Metals

Traditional metal mining involves significant environmental consequences while digital tokenization comparatively cuts down the long process and is more sustainable for the environment and of course a better investment instrument.

The usual and very common way of investing in metals is through traditional precious metal purchases which typically involves buying physical forms of the asset as bullion or coins. Being a trusted investment choice over the centuries for its tangible ownership opportunity. While its drawbacks continue to prolong. From storage costs or warehousing costs to gaining insurance, risk of theft, traceability, and more.

Through Precious metal tokenizations, these drawbacks and shortcomings are individually addressed. Through digital representation, physical assets are stored securely in vaults and blockchain’s transparency and accessibility give clear visibility of the asset transactions, which is also immutable. The most highlighted feature is its ease of buying, selling, and trading.

Say you will need to buy Gold as an investment, while choosing to get physical gold will involve more logistics and practical difficulties, making charges, etc. Instead when you buy gold as a token on blockchain the logistics and practicals are eliminated, while its market value stands the same, and as it grows it also continues to grow. And the major benefit here is the possibility to make investments in small units, through the concept of fractional ownership, inviting small-scale investments.

Working Of Precious Metal Tokenization

Precious metal tokenization as the name suggests the tokens here are backed by precious metals. For instance let's take Gold here as the precious metal that has to be tokenized. And you being the gold merchant, who wanted to tokenize your gold can now reach out to the blockchain developer team and avail their asset tokenization service

What happens here is you being the owner and the one having authority of the asset also be the custodian with whom the physical asset is safely procured. While with the blockchain team, they will help you curate tokens for the bullion assets in which each bullion will be associated with the token or portion of the token. Vitalising on IoT and other advanced services, the token can be enhanced with improved functionalities apart from just representing gold.

Once the token is minted and listed for sale or in DEX, the token transactions are recorded along with the buyer details on the network. This gives more clarity on tokens transactions, utility and more. While this can be matched with the equivalent asset from the custodian. The token buyer is considered the investors here who have the power to maximize the return while the physical asset stays under the custody of the custodian.

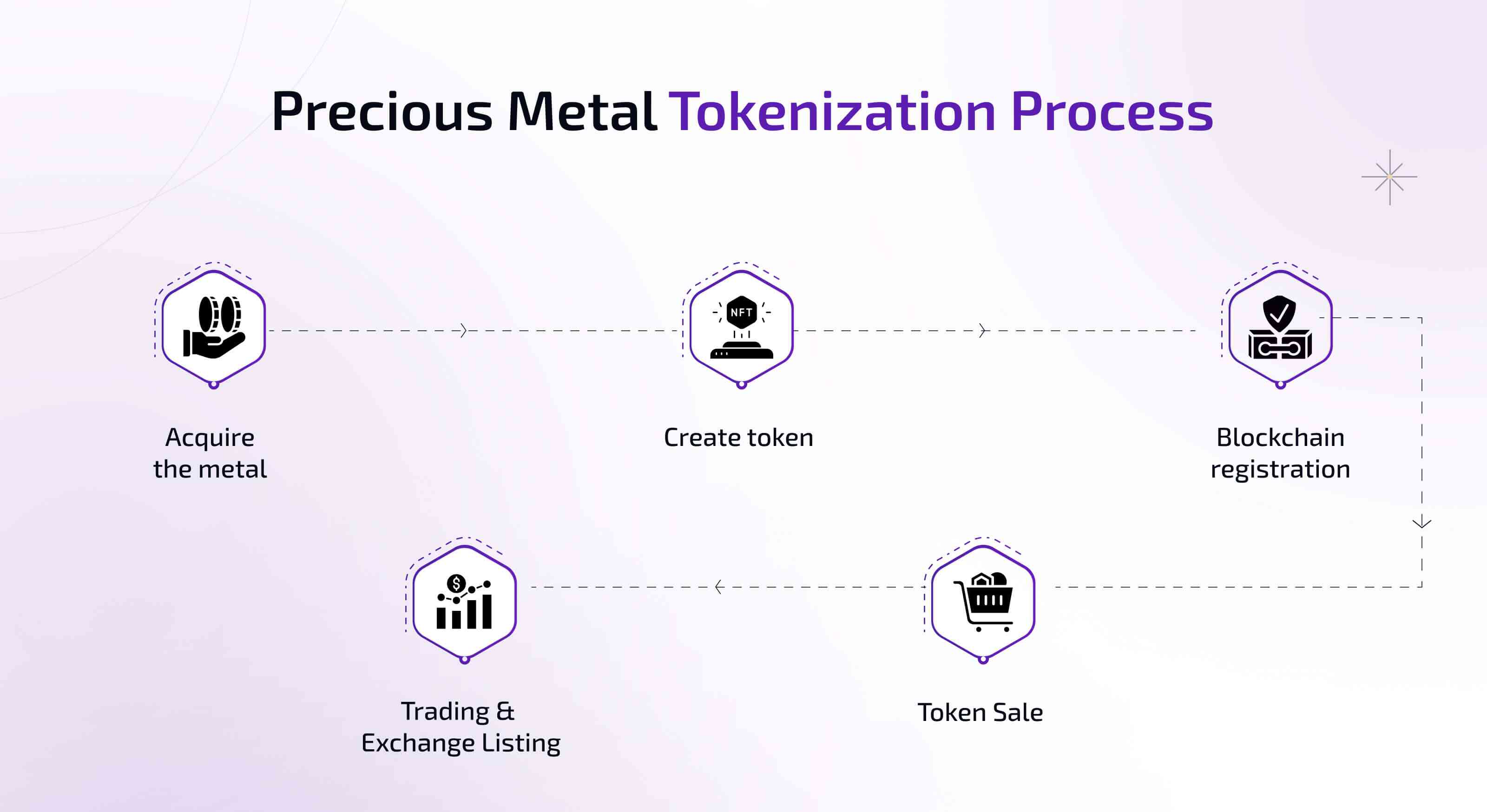

Precious Metal Tokenization Process

Breaking down the process of tokenization into small steps for better understanding.

1. Acquire the metal

The precious metal supplier can choose to store their metals in a vault and open it for purchase as digital tokens.

2. Create token

For creating digital tokens, on the network, tokens are created by defining their purpose, functionality, and value known as tokenomics. Here the metal quantity and the token quantity are measured as equal parts.

3. Blockchain registration

By registering them on the blockchain networks, on the chain, smart contracts are integrated to min the token, which creates a secured permanent record to ensure ownership.

4. Token Sale

The precious metal tokens are now ready for sale, they can be listed on ICO or another token sale platform to invite investors to buy, which eventually based on the demand increases the liquidity of the token.

5. Trading and Exchange Listing

The purchased token can be listed on trading platforms and decentralized Exchanges for buying equivalent tokens. The token value and metal value are coefficients of each other.

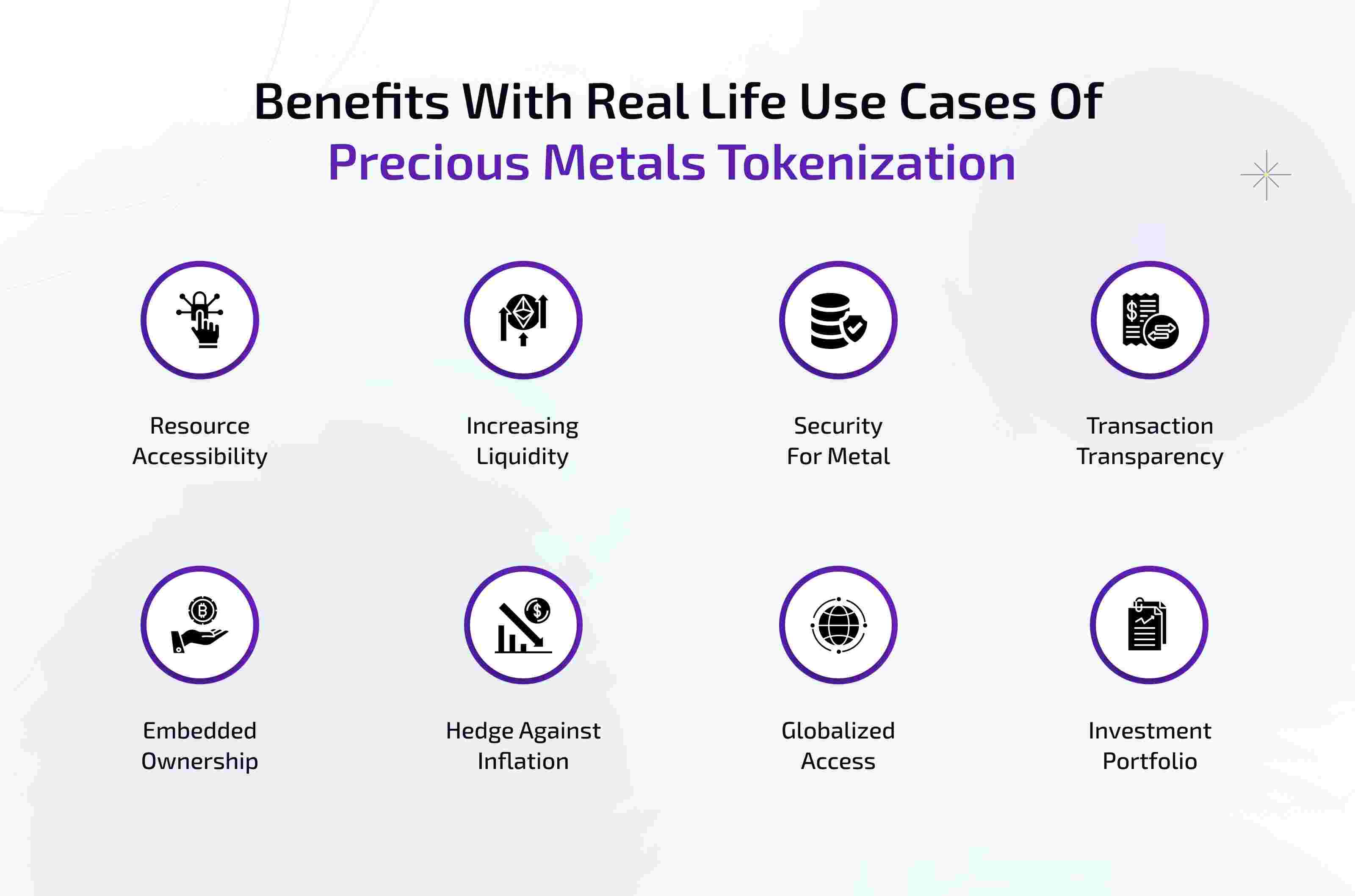

Benefits With Real Life Use Cases Of Precious Metals Tokenization

1. Resource Accessibility

Through Precious metal tokenization, the accessibility of resources is simplified, while it also opens up opportunities for investors from different margins to participate.

2. Increasing Liquidity

To trade tokenized metals is easy and possible to do, without any time restrictions while physician metal transportation itself involves a great deal of complications.

3. Security For Metal

With Precious metal tokenization, the technology backs it and ensures secured transactions while it also protects token ownership as it's recorded on the blockchain.

4. Transaction Transparency

Blockchain being highly transparent yet being served, the transactions related to tokenized precious metals are open to building trust among investors.

5. Embedded Ownership/h4>

The main advantage of tokenization on blockchain is the ability to own assets irrespective of the size of the investment. Based on the inventor's choice investments are made.

6. Hedge Against Inflation

Metals are already a good hedging mechanism, through tokenization it become even more accessible in the market for a comparatively wider crowd.

7. Globalized Access

By tokenizing Precious metals are open to access from anywhere anytime, overcoming geographical restrictions, and making it accessible globally.

8. Investment Portfolio

For investors who are looking to make a variety of Investments, opting to invest in tokenized assets would be a great choice.

How Is The Future Of Precious Metal Tokenization?

The future of Precious metal tokenization seems to be highly progressive as the adaptation standard and the interest received from versatile stakeholders are massive. Eventually, the welcoming has been highly contagious and inviting. Eventually, as new technology is being built around the blockchain market, the level of security, transparency, accessibility, and more. Eventually, Precious metal tokenization is also compatible with traditional financial systems, and the opportunity for investors is also at its peak. Eventually, the traction for Precious metal tokenization among varied countries is also promising, and yet the future of Precious Metal tokenization is itself very promising and profitable.