Your Complete Guide to Gold Tokenization in the Digital Era 2025

29 Nov 2024Listen to the Audio :

Gold tokenization is progressively altering the landscape of gold investment by integrating modern blockchain technology with its timeless allure. Gold tokenization converts tangible gold assets into digital tokens that are securely kept on a blockchain. In the wake of gold tokenization, investors can now trade and possess their tokenized gold with unprecedented ease and flexibility. Each gold token embodies a fraction of physical gold kept in safe reserve.

The advantages of gold tokenized in front of investors include an extremely high level of liquidity of its gold, fractional ownership with accessibility all over the world. Gold-backed tokens allow investors to enjoy security and stability in gold while enjoying flexibility in digital assets.

This article will delve into the mechanics of gold tokenization and what that means, how this concept impacts the landscape of seasoned and new investors within this fast-changing financial landscape that we have in the present.

What is Gold Tokenization?

Gold tokenization represents physical gold in digital form on a blockchain. A token refers to gold stored in certified vaults. One can equate the gold token with the amount of physical gold. In this context, the value of every gold token can be fundamentally linked with a real, actual asset. The blockchain-based tokenized gold will utilize the security and stability of gold while capitalizing on the flexibility provided by the blockchain.

With this tokenized gold, currently, the investors can attain fractional ownership; thus instead of a whole unit, one can now buy a fraction piece of gold. Other than that tokenized gold can be traded on digital exchanges that give higher liquidity than physical gold. Thus, gold tokenization has shifted dynamics in the gold market since this previously exclusive and inelastic investment tool now turns out to be highly liquid and flexible in terms of catering to modern needs.

Kickstart Your Gold Tokenization with our Gold Tokenization Development

How Does Gold Tokenization Work?

Gold tokenization is probably the most important leap that will bridge the gap between the physical and the digital world. Blockchain technology in tokenization transforms gold into an asset class far more liquid asset class and simpler access than any other precious metal assets. This more exact step-by-step guide shows how the gold tokenization process really operates:

The tokenized gold is procured from an independent source, such as a bank or custodian of assets. The physical gold gets held in an extremely secure vault that gets audited, meaning then each token would represent a guaranteed actual value held in gold.

There are gold-backed tokens, for each of which this token itself was issued as part of an amount represented by the digital tokenization, be it a gram or an ounce. The investor issues the gold-backed tokens. Hence, each token is directly associated with an amount of actual physical gold in storage.

All the issues on questions regarding gold token and how they are transferred find their answers on the blockchain. Therefore, a decentralized, tamper-proof ledger will allow users to verify if such a tokenized gold exists or owns it, thus offering trust and transparency in the process.

Conventionally, third-party independent auditors inspect the vaults, meaning that for every issued gold token, there has to be a corresponding gold asset in the physical world. It provides transparency, thus ensuring that tokens supply must be in accordance with the stored physical gold.

Tokenization of gold is so much different from the common gold investments since one would have fractions instead of having bars or coins, thereby making it accessible to many investors. It enables one to trade 24/7 on digital exchanges to enjoy liquidity that may not easily be facilitated by physical gold. These are characteristics which make it go much faster and make the portfolio very easy to handle.

This investment in gold becomes easier through the integration of gold tokenization, combining the advantages of blockchain, such as transparency and liquidity, accessibility from anywhere in the world, and the traditional stability of gold all in one.

What Are the Benefits of Gold Tokenization?

Gold tokenization has numerous advantages of carrying both security and stability, which gold gives, along with the adaptability of blockchain technology. Some benefits of gold tokenization include:

Gold tokenization provides an investor with fractional ownership in gold, and therefore, the access to this gold for investment is less complicated for a global audience. In opening up gold as an asset class for investment among a more extensive populace, it is no longer required to invest in entire gold bars or coins; instead, investors can purchase smaller portions that weaken entry barriers.

The gold token can be traded around the clock on digital exchanges. As such, liquidity, which is not easily found with physical gold, will be availed to the investor through gold tokenization. An investor can easily sell his holdings or buy and sell them to help manage a portfolio better or respond to the change of market conditions.

The transaction of gold tokenization is recorded by blockchain technology through a transparent and secure ledger. Real-time support from investment's tokenized gold boosts the trust and accountability with the investor.

With the process of gold tokenization, custodians will store the gold safely; thus, the investors will not have to worry about storing physical gold along with transportation costs. This lowers the total cost of owning gold.

Gold investment through other traditional systems usually requires massive purchases; however, through the tokenization of gold, it makes available fractional ownership. In this way, investors are able to acquire a small portion of the gold and own it at whatever price that can be reasonably bought.

The tokenized gold is traded all over the world. That allows the investors anywhere in the world to now access the gold market without any geographical boundaries. This global reach will add convenience to the investment option.

Redemption options are available in the platforms whereby the investors are able to redeem their tokens into actual physical gold, thus making them flexible enough to shift the digital holdings into the actual if they wish to do so.

Since gold traditionally falls under the type of asset considered stable, it would thus be used to act as a hedge against inflation as well as uncertainty over the economy. With the help of gold-backed tokens, this stability can then be introduced into diversified modern investment portfolios.

This gives gold tokenization the benefits attributed to gold, combined with some features from blockchain in a combination that showcases the latter in a more pliable, secure, and accessible form of investment.

Challenges and Risks in Gold Tokenization

Though there are several benefits provided by gold tokenization, certain challenges and risks should not be overlooked by investors before investing. Understanding these issues is required as a lack of awareness might push the investors to make some poor investment decisions within the sphere of tokenized gold.

Regulation in gold tokenization is constantly evolving. In that case, regulations of various jurisdictions differ, which may be the reason to form the difference between being legal and effective for gold-backed tokens. This brings difficulty for the investor regarding compliance, taxation, and amendments in the law.

Like other cryptocurrencies, the price of tokenized gold crypto could be at the mercy of a volatile market. Physical gold was very stable as a substance, but its digital tokens varied with market demands, speculative traders, and general trends within the overall cryptocurrency market.

Although blockchain technology seems pretty secure, gold tokenization has no exception from the vulnerabilities because hackers may target platforms where gold tokens are traded or stored. And as long as one depends on a third-party custodian then it is risky; this means investors should only utilize established, best-protected platforms.

Gold tokenization bases its operations on custodians holding the physical gold that backs the tokens. This means if an asset custodian manages funds poorly, goes bankrupt, or commits fraud, then there would be a risk concerning the value of such gold-backed tokens. It adds another layer of risk for the investor.

Gold tokens have better liquidity than physical gold. However, trading may become challenging when market activities are low. They are hard to be bought or sold by investors at the right price and are not at all times made available to all the platforms.

An investor should dig deeper to understand the hosting and custody companies involved in gold tokenization. Reputable providers should be transparent about their operations, showing apparent adherence to the regulatory requirements and good security systems in place.

One would know the latest updates in terms of regulations in the cryptocurrencies market as well as the gold market, thereby saving an investor from any legal issues. Of course, the law experts can decide what is necessary to be compliant.

Divest of investments will help to mitigate the volatile nature of market effects on an investor's portfolios. This way, diversified approaches will get tokenized gold alongside combinations in gold from standard investments. Aggregating all asset classes brings balance to the risk while establishing stability to guarantee maximum overall resilience in portfolios.

Tokenized gold crypto must be put into safe wallets. As such wallets, feature characteristics like 2FA and cold storage; they offer more protection features than common wallets. Such precautions make hacking and stealing almost nil.

Select the companies that would conduct periodic independent audits to prove that there exists a physical reserve of gold that backs their issued tokens. Transparency of operation will enhance the investor's confidence in the worth of their gold tokens.

This world of gold tokenization has challenges and risks. However, proper proactive approaches can help the investors mitigate the risks in such a scenario. Proper research, information, and secure practice will assure the investors and make them navigate the landscape of gold-backed tokens with all the benefits of the new investment approach.

Real-World Examples of Gold Tokenization

Gold tokenization is slowly and gradually becoming more popular worldwide with the increasing multiple platforms and projectarises to bring new potential into the alteration of gold investments. As provided below, there are some real-life examples of gold tokenization that explain their benefits and functionalities.

The Paxos Gold is perhaps one of the most important gold-backed tokens, mainly designed to facilitate the acquisition of gold using blockchain technology. Every PAXG token stands for one fine troy ounce of gold. These tokens can be bought and sold easily, and they can also be redeemed for the actual physical gold.

It comes with the ease of digitized transactions and stability of gold. It is regulated by PAXG under the New York State Department of Financial Services, hence all of its operations and activities are closely under review for complete transparency.

Another is Tether Gold, the tokenized gold crypto from which investors can hold the precious metal in a digital form. Each XAUT token is backed by one troy ounce of gold held in Swiss vaults. Tether Gold has made it easy for the investor to transfer his holdings of gold; therefore, granting liquidity and accessibility. Their investment is flexible since investor redemption of their tokens can be done into actual gold.

DigixGlobal is one of the first platforms to come up in this gold tokenization space. Every DGX token supports one gram of gold, which is safely kept in vaults. The Ethereum blockchain will be used to ensure that there is transparency and traceability for the gold that supports each token. Investors can buy, sell, or redeem their issued DGX tokens for physical gold that they can hold.

This means that investors will be presented with a practical means through which they can invest in gold digitally. Another innovatory proof of assets DigixGlobal introduces is that one particular token of gold somehow links to some particular bar of gold to establish further confidence in the procedure as a whole process for the tokenization.

GoldMint is the gold tokenization platform that specializes in tokenized gold using its gold-backed tokens which are termed GOLD. This model bases itself on the blockchain model, it ensures the issued GOLD is always supported fully by actual physical gold held within vaults for safety purposes.

It aims at creating the existence of a marketplace of these tokens to create investment opportunities for more individuals. There is a lending service in the ecosystem where users can borrow loans by using their gold tokens.

ABX is an exchange that also provides a marketplace to sell, buy, and trade tokenized gold. With its exchange, the consumer can buy parts of the gold in digital tokens by purchasing portions of it whereby each token corresponds to its counterpart in gold.

ABX takes into consideration security and transparency as the actual gold inventories are continuously tracked in real-time as the physical gold is periodically audited to ensure that its issued tokens are always well collateralized.

Vaults create a platform where it unites the blockchain mechanism and gold tokenization towards an efficient method of putting funds into the gold security. Every vault chain, for instance, represents particular amounts of stored gold and kept in an accredited storage vault.

Along with the provided platforms of trading, financing and instant redemption to the owners, interest in gold investing would, therefore, be quite regulatory for investors. VaultChain improves gold market liquidity since it offers a faster transaction and access globally.

Kinesis provides digital tokens backed by gold combining blockchain technology with physical metal storage. Holding or spending KAU which is backed by fully allocated gold that is safely vaulted around the world, allows users to earn dividends.

DigixDAO supports each DGX token it emits with one gram of LBMA-approved gold. Tokens provide a clear and easy method to invest in gold digitally since they are completely redeemable, divisible and securely audited.

Owning digital gold backed by vaults in the US, Canada or Switzerland is made possible via OneGold.It offers an efficient and trustworthy method to convert both digital and real gold and it is endorsed by Sprott and APMEX.

The Western Australian Government completely guarantees PMGT a government-backed tokenized gold asset. The Perth Mint backs it with gold ensuring safe, audited and redeemable ownership through the Ethereum blockchain.

Such everyday examples of gold tokenization are reflective of the strength that a combination of blockchain technology with gold investments can hold. Through these portals, the landscape of tokenized gold is rapidly transforming into being secure, transparent, and accessible to invest in gold so investors can enjoy the stability that comes with gold with the advantages brought by digital assets.

Gold Tokenization vs. Traditional Gold Investment

The gold tokenization is bringing a new way of investors handling their gold, showing new possibilities regarding investments in gold versus the long-standing practice of investment in gold. Both access this precious metal, but they are quite different in many aspects. Here, features and benefits of tokenizing gold are compared with the traditional gold investments.

1. Ownership Structure

Gold tokenization is the blockchain representation of actual gold in the form of digital tokens. Thus, every token portrays some set of genuine gold safely resting in vaults and allows fractional ownership, enabling investors to purchase smaller fractions of gold rather than bars or coins whole.

Purchase of physical gold in the form of bars, coins, or jewelry is known as a traditional gold investment. It provides direct ownership but usually pays a very high premium to buy larger quantities of gold.

2. Liquidity and Accessibility

Tokenized gold is quite liquid, since it may be sold at a digital exchange round-the-clock. This openness gives the possibility for an investor to promptly enter or leave the given position; thereby it allows him to make changes within his portfolio according to a better reaction to fluctuations in the market.

It cannot be sold physically overnight. Some added costs, in addition to the above list, can be shipping and insurance costs. Market hours and availability of a ready buyer could limit liquidity inasmuch as assets may not easily be sold over night quickly.

3. Storage and Security

Physically, gold is held in highly audited secure vaults under control of extremely reliable custodians using highly reputable methods. Storage, theft and insurance matters are managed by the token issuer.

It would require a security deposit to house the actual gold, or use of a house safe, so assignment of layers of duty and likely expenses including security and insurance.

4. Verification and Transparency

Gold-backed tokens feature blockchain-based technology that will have an open, tamper-proof ledger to document every transaction or token issuing. It improves the level of trust because investors can easily verify their portfolios.

Of course, a traditional gold investment is always regulated, but authentication and provenance of physical gold are almost impossible to trace. Investors depend upon some certificates and appraisals rather than blockchain records which are less transparent.

5. Costs and Fees

Gold tokens can cost much less than any conventional investment. It is because the fee charged in buying or selling tokens is relatively low but, in most instances, way lower than premiums in physical gold.

Investors in physical gold pay a premium over and above the market price of coins or bars, and in addition to this pay shipping, storage, and insurance costs. These can mount up and decrease the net investment returns.

6. Flexibility and Features

Other benefits that some platforms have been adding to the owning of gold tokens are direct redemption in physical gold, interest on holdings, and lending collateral from tokens. This can afford a relative alternative in handling investments.

Although these conventional assets might have been preserved or liquidated, they had the disadvantage of having in effect virtually no kind of financial flexibility and some perks only linked with digital investments.

Each type has its advantages, and the different types cater to the varying needs of investors. Higher liquidity, security, and flexibility characterize gold tokenization and appeal to the convenience-seeking and efficiency-minded investor of modern times.

On the other hand, direct ownership and an established long-standing investment vehicle burden the traditional gold investment, making it suffer from logistical problems and a higher cost. The investor should select between these two styles based on his goals and his preferences.

How Is Gold Tokenized?

Gold tokenization provides investors with an opportunity to trade and own gold conveniently and securely. Here is a detailed step-by-step breakdown of how gold is tokenized:

The physical gold is taken for the verification and authentication process; the set requirements are then confirmed during this process and will validate the weight, purity, and authenticity of the gold. This ascertains that every minted token is covered with the equivalent amount of actual physical gold, hence never violating the integrity of the process.

The investors or custodians then proceed to select a platform that allows for tokenization of gold. The appropriate platform should be compliant with the required standards of regulatory terms and should have the proper infrastructure to come up with, manage, and trade gold-backed tokens. The chosen platform would affect safety and efficiency and how easy it was to tokenize.

This is the stage where the digital tokens representing the gold in the vault are created. Usually, some amount of gold will be represented by each digital token. This also happens through smart contracts in a blockchain, so everybody knows that tokens are produced.

Once the tokens are minted, then they are released to the investors as gold-backed tokens. Each token represents ownership of a fraction of reserve gold, therefore giving an investor fractional ownership. A person can thus buy a smaller portion of gold; sell or trade it by not necessarily getting an entire bar or coin.

All issuance of each gold-backed token takes place on a blockchain, which is a decentralized, tamper-proof ledger recording every issue. It, therefore, becomes easier for the investor to verify his existence and ownership of a tokenized gold. The system tends to be open and published with each transaction that goes through, thus further adding up to the investment with layers of trust.

Once they have released the gold tokens, these can be traded on other platforms and exchanges. Investors can sell or buy shares anytime and realize the liquidity benefits of tokenization. All transactions are secured using the blockchain network, with a record of all transactions along with the history of ownership and transfers.

It also has a check on vaults where physical gold is stored, as those vaults are regularly audited by independent third-party auditors to establish confidence and transparency. In doing so, it will be ensured that every token possesses real gold backing, just like the same number of tokens have been issued against the reserves of physical gold.

Gold tokenization amalgamates the stability and value of physical gold with innovative blockchain technology. Of course, once you work through these simple steps, gold tokenization makes approaching this timeless asset from the investor's standpoint much easier. Gold is no longer something relegated to the hands of merely a few but rather something more accessible with greater liquidity and transparency available to investors.

Whether one is new to investment or has become an investor seasoned enough to understand the niceties concerning gold, it is going to be a knowledge companion that will navigate you on this journey.

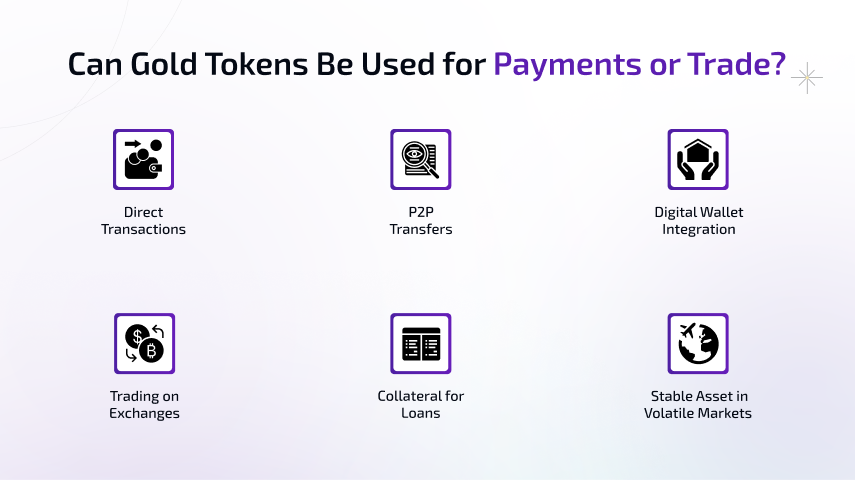

Can Gold Tokens Be Used for Payments or Trade?

Yes, most gold tokens can be traded on the cryptocurrency exchange and, to some extent, even paid for in exchange for certain goods. Still, its acceptance will largely depend on the exchange or website using it and local regulations. Gold tokens are revolutionizing the way we go about transactions because they have stability in gold with convenience through digital assets. Here's a quick glance at their capabilities:

Gold tokens may provide for direct payment in goods and services and, therefore, stabilize value to cut off the volatility typical for cryptocurrencies.

Blockchain technology provides for a smooth execution of peer-to-peer transfers in gold tokens without any need for intermediaries. Transaction fees are reduced, as well as speed and security.

Today most digital wallets recognize gold tokens; one may store, send, or receive those just like cryptocurrencies.

There are many digital asset exchanges where one can trade in gold tokens. Hence, there will be a form of liquidity where one can easily convert them into cash or other assets.

Some platforms allow customers to pledge gold tokens for borrowing purposes, thus keeping their liquidity without selling their gold-backed assets.

Gold tokens hedge against economic uncertainty by employing the intrinsic value of gold to shield transactions from inflationary and currency devaluation activities.

Gold tokens offer a flexible and secure means of payment and trade. Gold tokenization combines the security of gold with the innovation of digital transactions.

Top Platforms to Launch Tokenized Gold in 2025

Clone Script Platforms

Launching a tokenized gold on a clone script is an effortless process that gives you smooth results. This clone script is a ready-made software platform that replicates the core features and functionalities of existing tokenized golds like Tether Gold, GoldMint, or Paxos Gold. These platforms are primarily incorporated with features like wallet integration, token creation, a trading dashboard, an admin control panel, KYC/AML protocols, and more in beforehand.

So, by using this script, anyone can tokenize their own gold by modifying the features to fit with the respective gold tokenization model. No more delay; pick a reliable clone script provider, and partner with a developer like BlockchainX to make the script adapt to your business desires.

White-Label Platforms

If you are searching for a platform to quickly launch your tokenized gold at an affordable price, investing in a white label gold tokenization platform will be the right choice. This highly efficient platform helps users enter the blockchain-based tokenzation quickly without the need to develop it from scratch. However, it is ideal for startups and gold dealers who wish to reach the market in a short time without any technical complexity.

By integrating with our tailored experts, we help you customize and blend the gold tokenization platform to fit with your features and user experiences, including custody & compliance, fractional ownership, redeem options, and more. Join us today—seamlessly buy, sell, and trade tokenized gold easily.

Custom-Built Platforms

Unlike clone scripts and white-label platforms that come with standard templates, a custom-built platform allows you to design your own features and integrate enhanced compliance measures into your tokenized gold from the ground up. By choosing this platform, any user can take complete control and access over their gold’s features with enhanced security and scalability.

Beyond these advancements, a custom-built platform takes a long-term market launch, increases development expenses, and requires a team of skilled developers for a successful deployment of the tokenized gold.

If you are still longing for long-term sustainability, partner with our BlockchainX team and use the custom-built platform to create a reliable and compliant tokenized gold environment.

Future of Gold Tokenization

Gold tokenization, in the near future, will have gigantic growth prospects in terms of increasing interest in digital assets and growing demand for more accessible investment options. The gold tokenization will pick up further momentum and get acceptance as more people from the retail and institutional investment sides will be more engaged. Better regulation will ensure confidence and credibility in using the gold-backed tokens. Hence, the demand for it as an asset class will increase.

Innovative platforms would be created to join tokenized gold crypto with decentralized finance (DeFi), whereby one may borrow against their gold or use it for yield farming. Once acceptance becomes wider, merchants will be able to begin to take gold tokens for transactions, which will start creating a frictionless payment system and trade.

Blockchain technology development will be coupled with the enhancement of security, transparency, and efficiency and ensure every gold token reliably backs its corresponding physical gold. At the end of the day, gold tokenization will revolutionize investment in gold and usage patterns by taking traditional and placing it inside modern finance.

Download the PDF : Gold Tokenization.pdf

How BlockchainX Can Elevate Your Gold Tokenization Project

BlockchainX is a one-stop solution for gold tokenization services. We combine knowledge of blockchain technologies with a strong awareness of financial markets to bring comprehensive solutions. Our approach ensures hassle-free gold tokenization with security at the forefront and adherence to the most stringent legal requirements.

Our experts design gold-backed tokens that reflect the real value of actual gold assets. Advanced smart contracts allow us to enable open, fast transactions; this makes perfect buying, selling, and trading of tokenized gold possible. Our blockchain system promises transaction integrity, which gives investors peace of mind.

We are focusing majorly on the user experience. Hence, we create easy-to-use interfaces through which one can easily access the tokenized gold crypto. BlockchainX provides strategic consultancy and marketing know-how to help your project achieve its best possibilities. We are here mainly to promote increased participation, and to draw more business.

Our team understands the complexities of gold tokenization. We are committed to creating solutions tailored to your unique vision. Let's work together on how to drive your project forward and open new opportunities into the future, shaping how people invest in gold.