10 Steps to Create Your Own Decentralized Exchange

03 Dec 2024Listen to the Audio :

Making a decentralized exchange (DEX) may seem challenging initially, but it is simple once you break it down. This blog will teach you everything you need to know first to create decentralized exchange and we will go over everything simply beginning with the selection of a blockchain and ending with the configuration of smart contracts.

DEXs are gaining popularity due to their ability to eliminate intermediaries and facilitate direct cryptocurrency trading between users. Because of this—they are private, safe and often faster than regular transactions. The only thing that we want to do is give you a wonderful experience while also leaving your personal information safe. You may want to find out more about how cryptocurrency exchange development company and decentralized cryptocurrency markets are growing. Follow us as we start your journey.

Decentralized Cryptocurrency Exchange

On a decentralized crypto exchange—people can trade cryptocurrencies with each other without the need for a single authority to watch over the deals. Decentralized exchanges (DEXs) don't use a central authority or another third party to handle user funds. Instead- they use blockchain technology and smart contracts to let people trade with each other. Because blockchain records transactions—DEXs put privacy and openness at the top of their list of priorities. This is because blockchain offers security and lowers the risk of breaches.

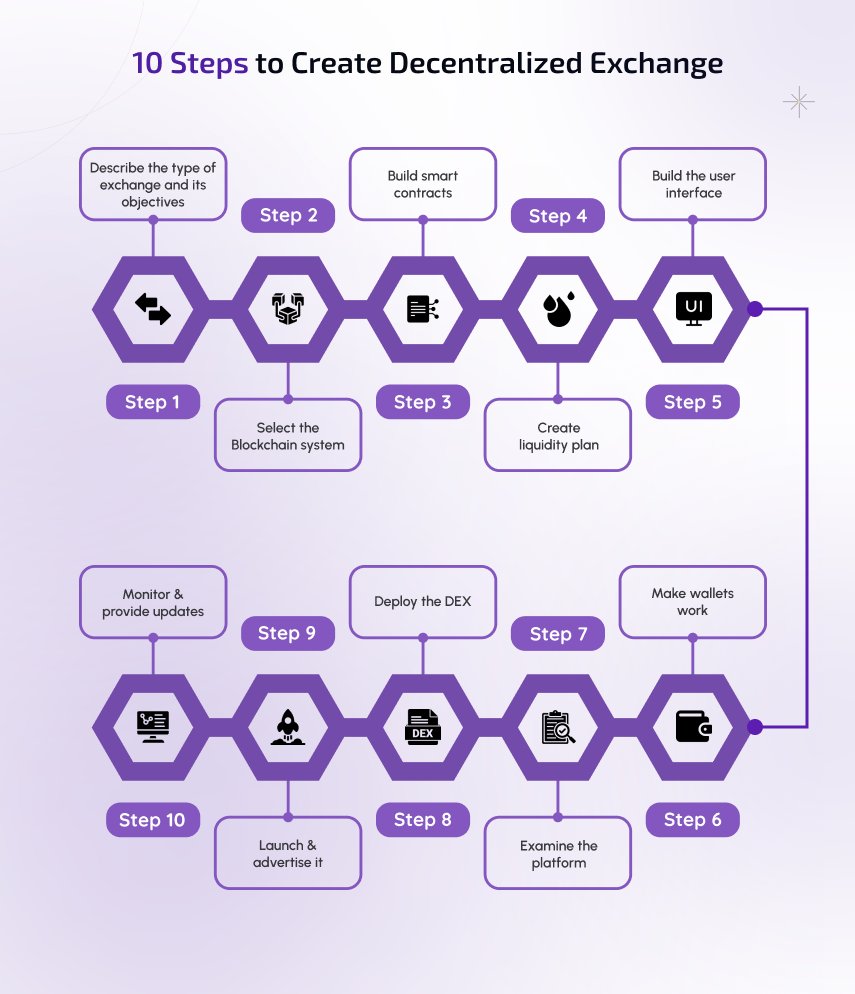

10 Steps to Create Decentralized Exchange

There are several technical phases involved to create decentralized exchange (DEX) from designing the architecture to security and compliance assurance. This is a broad synopsis of this process.

Step 1 - Describe the type of exchange and its objectives

Choose a DEX type such as (Aggregator, Order Book Model or Automated Market Maker (AMM)).

Determine the project's objectives, target market and unique selling points.

Step 2 - Select the Blockchain system

To deploy the DEX—Pick a blockchain like Ethereum, Binance Smart Chain or Polygon.

Consider elements such as token compatibility, network speed and transaction fees.

Step 3 - Build smart contracts

For essential components like fees, liquidity pools and the exchange of tokens—you should make smart contracts.

Thoroughly test the contracts to make sure they work and are safe.

Step 4 - Create liquidity plan

You need to choose the right method for systems that provide liquidity like Automated Market Maker liquidity pools.

You could give liquidity providers trading fees or reward tokens as a reward.

Step 5 - Build the user interface

Create an easy-to-use interface that lets people see prices, link their wallets and make purchases.

Make sure that the blockchain and user interface work well together.

Step 6 - Make wallets work

To allow users to engage with the DEX and provide wallet connectivity for popular cryptocurrency wallets (such as Metamask and Trust wallet).

Step 7 - Examine the platform

Conduct thorough testing such as stress tests, user experience testing and security audits of smart contracts.

Determine and fix any possible vulnerabilities

Step 8 - Deploy the DEX

Deploy the UI and smart contracts on the selected blockchain

For user transparency–confirm and publish contract addresses

Step 9 - Launch and advertise it

Launch the platform and make sure to onboard early users and maintain liquidity

Use partnerships, forums and social media to promote the DEX.

Step 10 - Monitor and provide updates

Monitor the platform performance, usability and security.

Make updates available in response to the feedback received from the community and changing requirements.

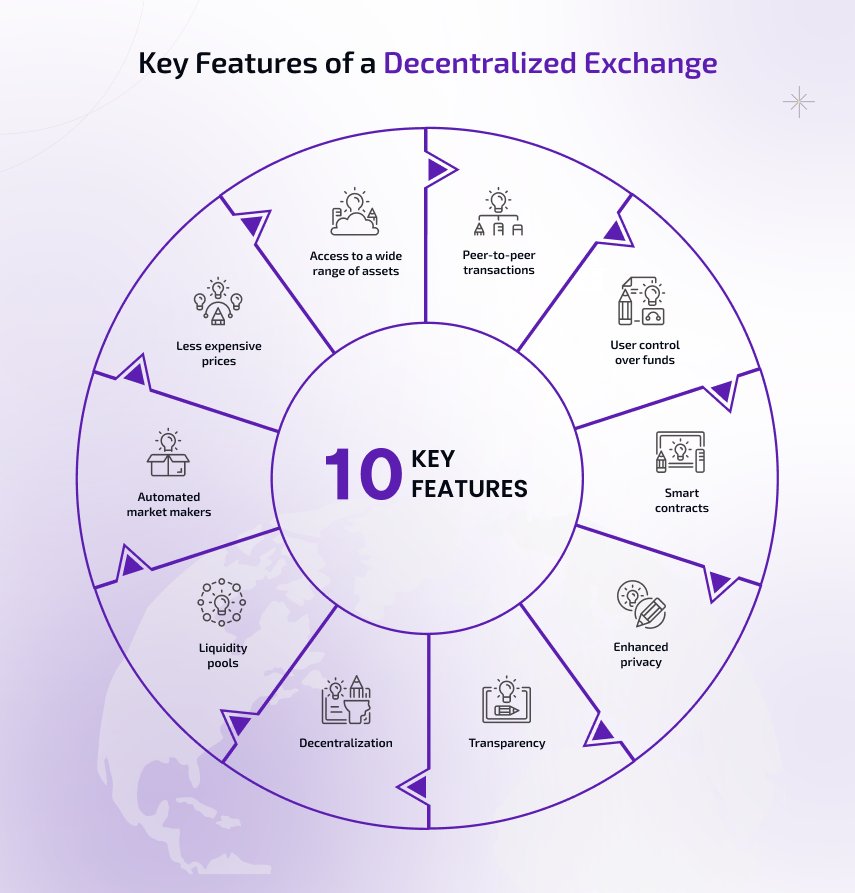

Key Features of a Decentralized Exchange

Peer-to-peer transactions

DEX users can trade cryptocurrencies with each other directly, without going through a middleman. Because users can talk to each other directly there is no need for a central authority or guardian. This makes privacy better.

User control over funds

The risks of centralized fund storage are smaller with DEXs because users keep control of the funds in their wallets. DEXs are safer than centralized crypto exchange platforms because they dont keep user funds. This makes them less vulnerable to major hacks and breaches.

Smart contracts

Smart contracts are self programming contracts stored on the blockchain—DEXs use them. These contracts create a safe and open trade environment by ensuring that transactions meet certain conditions before they go through. There is no need for middlemen to verify or manage the transactions.

Enhanced privacy

Traders who care about privacy will like DEXs because they don't usually ask for personal information or full ID proof from their users. On the centralized platforms—users often have to go through detailed identity verification. This implies that users can trade without detection.

Transparency

Since the blockchain records the transactions on DEXs—anyone can view and verify them making them highly transparent. Because transaction data is immutable and accessible to everyone in the network, users can trust the platform will operate fairly.

Decentralization

As DEXs are decentralized—companies encourage autonomy and make censorship less likely. In line with the basic ideas of blockchain technology, this decentralized structure makes sure that users' assets stay under their control and are not subject to centralized oversight or interference.

Liquidity pools

Users can deposit their funds into liquidity pools to make trading on DEXs easier. Liquidity providers benefit and earn rewards from trade fees in exchange for establishing a strong structure for continuous trading even in the absence of buyers and sellers.

Automated market makers

AMMs use systems to figure out the prices of assets based on supply and demand which lets trades happen without having a trade with a direct counterparty. Customers can still make trades work even if buyers or sellers are not available at the moment because this system is always liquid.

Less expensive prices

Most of the time—DEXs have lower transaction fees than centralized exchanges as they don’t have to pay for expensive equipment or middlemen. When DEXs connect traders directly through blockchain technology they can offer a cheaper trading experience with less overhead.

Access to a wide range of assets

Many DEXs list new assets and tokens that centralized exchanges might not provide. Users may access a greater range of tokens with this open listing strategy especially those from new or specialized initiatives inside the cryptocurrency ecosystem.

Security Considerations to Create decentralized Exchange

Decentralized cryptocurrency exchanges (DEXs) are innovative tools that let people trade with each other without a central authority. DEXs have unique security problems since they are decentralized and rely on smart contracts in complicated ways. However—it also offers better privacy, control and accessibility. Here is a list of regular threats and possible ways to stop them.

Typical DEX security threats:

Hacking

There may be vulnerabilities in blockchain systems and smart contracts that hackers can exploit. Hackers often go after to target these to steal money, use liquidity pools to their advantage or damage the reputation of the platform.

Fraud

Phishing efforts, fake tokens and imposter platforms can trick people into divulging private information or engaging in illegal activities.

Important DEX Security measures

Encryption

Use robust encryption protocols to protect data storage and communication. SSL/TLS protocols ensure data privacy by preventing interceptions or changes to transaction information.

Multi-signature wallets

By demanding multiple key permissions for every transaction—multi-signature wallets increase security and lower the risk of fraud and unauthorized access.

Regular updates and security audits

Regular checks are necessary for platform software, smart contracts and overall infrastructure. Keeping up with security patch updates helps keep you safe from new threats and vulnerabilities.

Types of Decentralized Crypto Exchange

To create crypto exchange—decentralized cryptocurrency exchanges serve various user requirements and trading preferences.

Here are the five main types of Decentralized cryptocurrency exchanges (DEXs).

Automated Market maker

Trades may occur on Automated market maker (AMM) DEXs that use liquidity pools. Users no longer need traditional order books since they can trade directly with these pools. Decentralized exchanges commonly use this approach to ensure steady liquidity and automate dealing.

Order Book DEXs

These decentralized markets work the same way that regular ones do. Using an order book they match buy and sell orders based on price and amount. This type of DEX gives traders more freedom and power but it might not work as well as AMM DEX.

Hybrid DEXs

The functions of these DEXs are like those of both order book DEXs and AMMs. They often mix order books and liquidity pools to give traders a wider range of options. This approach can provide a comprehensive trading experience by merging the flexibility of order books with the speed of AMMs.

Layer-2 DEXs

Layer-2 DEXs are built on the utmost of existing blockchains to make them more scalable and reduce the cost of transactions of users. If you use sidechains or rollups to handle transactions off-chain—you can greatly increase throughput and decrease congestion.

DEX Aggregators

The system analyzes multiple DEXs to identify the trade with the best prices and the highest volume. Connecting multiple DEXs—enable your customers to access the best trades without the need to use multiple platforms. These changes could be helpful for traders who prioritize speed and price first.

How to Ensure Liquidity in Your Decentralized Exchange

A decentralized exchange (DEX) liquidity is crucial for user satisfaction and seamless effective trading. Automated Market Maker (AMM) models frequently implement liquidity pools as an efficient strategy where users—serving as liquidity providers—deposit tokens. These pools provide liquidity providers financial incentives to retain funds in the pool by allowing other users to trade against the assets in the pool in exchange for a portion of transaction fees.

Many DEXs implement liquidity mining methods which enable users to earn incentives such as native tokens, governance rights or bonuses for providing liquidity to enhance user engagement. Promoting long-term involvement—these initiatives not only attract liquidity but also aid in maintaining it. Providing yield farming possibilities or partnering with projects to offer token incentives can increase liquidity even more, attract traders to DEXs and enhance overall trading efficiency.

Technology Stack for Decentralized Crypto Exchange Development

Blockchain platform

Ethereum, Binance smart chain, Solana and Polygon

Smart contracts

Solidity for Ethereum, BSC and Polygon, Rust for Solana

Front-End development

React.js, Vue.js, Web3.js, Ether.js

Backend and API

Node.js, Express.js and Infura or Alchemy

Security and Testing

Ganache, Hardhat, Truffle

Database and Storage

IPFS and MongoDB

How Much Does It Cost to Create Decentralized Crypto Exchange Development?

How much it costs to create a decentralized exchange (DEX) depends on the technology stack, the features that need to be added and the knowledge of the team working on it. A list of some of the potential costs is presented here

Basic expenses of DEX development

Generally speaking—a basic DEX with basic trading capabilities like wallet integration, liquidity pool and easy token exchanges costs between $50000 and $150000.

This cost may not include advanced features like yield farming or staking but it does incorporate wallet integration, front-end interface development and smart contract development.

Customization and complex features

Development costs may go higher if you include advanced functions like yield farming, staking, liquidity mining or multi-chain support.

Depending on the features and technical specifications—a DEX with these extra functions might cost anywhere from $150000 to $500000

Security audits

There needs to be a full security audit because managing cryptocurrency assets comes with a lot of risks. Smart contracts audits on DEX usually cost between $10000 and $100000 but this depends on how complicated the contract is and how popular the audit company is.

Maintenance and improvements

Updating, maintaining and adding security patches usually cost additional money which could be anywhere from 10% to 15% of the starting cost of development per year.

Structure of the development team

Blockchain devs, front-end and back-end developers, UI/UX designers and QA testers are usually on a good team. Costs may also be impacted by working with an experienced development company or hiring a team internally.

Remote or freelance developers may be less expensive but they may also be less reliable and coherent. Hourly rates vary from $50 to %150

Blockchain development companies—usually cost between $100 and $300 per hour but they offer full services and project management.

Total Estimated cost

A well-rounded DEX with a solid security phase and a modest level of complexity should cost between $30,000 to $500,000. Feature-rich, High-end platforms can cost more than $500,000.

Future Trends in decentralized Crypto Exchanges

More innovations and breakthroughs will happen in decentralized crypto exchanges (DEXs) in the future as the business grows and develops. Here are some trends we expect in the future.

Cross chains and multi-chain compatibility

DEXs make it simple to trade between multiple blockchains as the need for multi-chain interoperability grows. Cross-chain protocols and bridges will continue to grow as projects like Polkadot and Cosmos make these connections possible. This makes it easier for users to move assets without the need for middlemen.

Layer2 Scaling options

Since major blockchain transactions are slow and gas fees are high. DEXs are using Layer2 solutions such as Optimistic Rollups and ZK-Rollups. By lowering fees and speeding up transactions—these technologies make trading easier to scale and more cost-effective.

Better accessibility and user experience

To draw in more users—DEXs are spending money on interfaces that are easier to use and more intuitive. This means adding fiat-to-crypto gateways and training classes—so that DEX platforms are simple for new users to understand.

Decentralized Autonomous Organizations (DAOs) for governance

Token holders can now participate in decision-making through the growing adoption of DAO governance by decentralized exchanges. Community governance promotes a decentralized and user-focused ecosystem by giving users the ability to impact the platform updates, modifications and fee schedules.

Strengthen security protocols

Since smart contract hacks are becoming more common—security will remain a top priority. Improvements in insurance funds, multi-signature wallets and real-time audits will help protect users' money and keep them safe from attacks.

DEX Aggregators

Aggregators such as 1 inch and Matcha gather prices and availability from multiple DEXs. These aggregators are always changing and they will make prices and liquidity more efficient by letting traders find the best prices across multiple sites.

Privacy enhancing features

More users are worried about privacy when dealing with cryptocurrencies. In the future—DEXs might include privacy-focused features like MPC (multi-party computation) or zk-SNARKs (zero-knowledge proofs) to help keep user information and transaction data safe.

Integrating Real-world resources

More DEXs are trying to tokenize real estate, stocks and bonds to increase the variety of assets. By bringing current financial markets closer to decentralized finance (DeFi) this trend may make DEX more useful and popular.

Creating Decentralized Crypto Exchange—How blockchainX makes it Simple?

BlockchainX offers full-packed solutions that make the development process easier and faster. This helps create decentralized exchanges (DEXs). Here are some ways that blockchainX can help.

Fast deployment

When compared to building from scratch—BlockchainX offers pre-built smart contracts and modules for quick deployment greatly cutting down on development time.

Customized smart contracts

Unlike generic templates seen elsewhere—BlockchainX offers audited and configured smart contracts that may be adapted to specific DEX requirements.

Strengthened security

Provide protective measures that go above and beyond typical development methods and emphasize security with strong audit protocols and testing.

Compatibility across chains

Unlike platforms that only support single-chain operations—we support various blockchain integrations for cross-chain trade enabling a larger user base.

Simple interface

DIY setups often don't have design options that focus on the user. BlockchainX on the other hand has customizable and user-friendly interfaces that make the user experience better.

Integrating wallet

As we support popular wallets like Metamask natively which makes wallet integration smoother than with more general options.

Managing the Liquidity pool

We use pre-built modules to simplify the setup and management of liquidity pools compared to standard settings that require manual labor.

Conclusion

To make an independent cryptocurrency platform, you need to know a lot about blockchain technology and how the cryptocurrency market works. For the long-term success of your platform and a smooth user experience—you should put protection, scalability and utility at the top of your list.

A professional development approach can assist you in addressing common issues such as ensuring high liquidity and creating a simple interface to understand which is customized for a target audience. To avoid problems—it is important to choose an organization that knows about blockchain and cryptocurrency.

Do you need skilled developers to comprehend your cryptocurrency platform idea? BlockchainX starts from scratch when creating digital products. From market research to advanced user interface and user experience design and powerful back-end solutions—our team can help you succeed with your project.