Asset Tokenization on Blockchain: A Complete Guide for 2026

10 October 2024Listen to the Audio :

Asset tokenization on blockchain is a trend that's in high adoption and is blooming with an expectation to meet $16 trillion a market capital by 2030. Tokenizing real assets is the digital transformation of real-world assets, be it anything in this universe you own, can be made as a digital token representing your asset with trading abilities, and also add up other functionalities.

Real World Asset Tokenization Services are gaining massive traction among the investor panel in recent times. Meanwhile Asset tokenization on decentralised networks gives a sense of accessibility, transparency, and security for the same.

Let us get into the details of Asset Tokenization on Blockchain: a complete guide, how it works, the tokenization process involved, benefits, monetary opportunities, and future

Asset Tokenization on Blockchain

The act of converting physical assets like stocks, artwork, commodities and real estate into digital tokens that are stored on a blockchain is known as asset tokenization solution on blockchain. It is simple to trade, transfer or divide these tokens into fractional shares as they reflect ownership rights.

Tokenization increases asset liquidity, lowers transaction costs and broadens investor access by utilizing the transparency, security and immutability of blockchain technology. Traditionally illiquid assets are converted into more easily accessible and effective financial instruments.

From banking and real estate to art and intellectual property—this creative method is completely changing how we hold, invest in and trade value.

Asset Tokenization on Blockchain—Explained

Beyond this, let’s discover how blockchain focuses and serves as the foundation for asset tokenization.

Smart Contracts for Automation

Blockchain allows the creation of smart contracts and automates processes such as trading, token issuance & distribution, and compliance checks with their self-executing programs. This eventually eliminates intermediaries and minimizes operational cost and human error, ensuring the transactions are done in a secure and speedy way.

Immutable Digital Representation

Any physical, intangible, or illiquid assets can be easily purchased and traded without third parties. The token's ownership is recorded immutably on the blockchain, making the assets more secure and transparent for a wide range of users.

Fractional Ownership

The blockchain-based tokenized assets are divided into more affordable digital tokens, making them easily accessible and tradable by multiple investors. It opens new investment opportunities by reducing the low entry barriers for small investors.

Enhanced Liquidity

Assets like real estate, art, and commodities are fractionally tokenized on the blockchain platform, making any traditional illiquid assets easily accessed, traded, and managed globally 24/7. This simplifies and increases the market liquidity, opening new investment opportunities.

Transparency & Verifiability

Users get enhanced transparency of their token transactions, which are stored on a decentralized public ledger, building trust in the ownership and transfer process among investors. This act reduces fraud risks and enables investors to invest in and trade the tokenized assets.

Want to bring your assets to the blockchain? Connect now

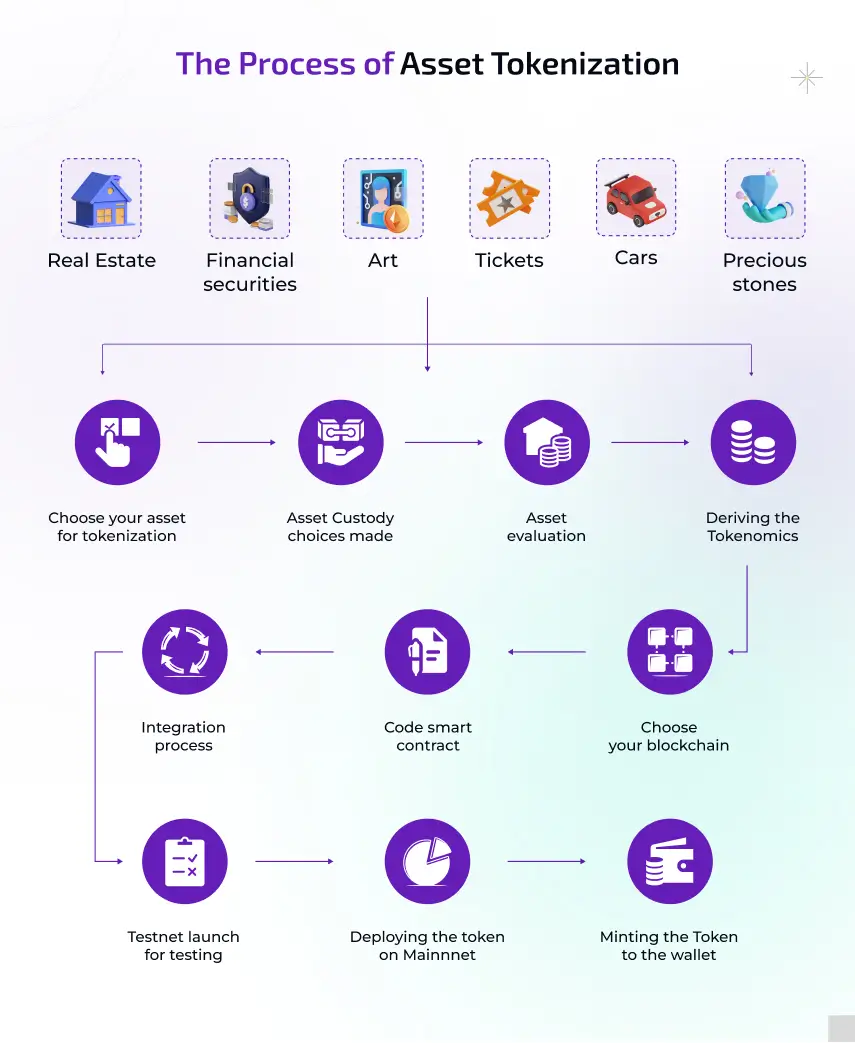

The Process of Asset Tokenization

Asset Identification

Select a digital or physical asset that is tokenized such as intellectual property, commodities, art or real estate.

Legal Structuring & Compliance

Create a legal framework & regulatory compliance to guarantee the assets' safe, legal and transparent tokenization.

Asset Valuation

Conduct an expert valuation to ascertain the assets market value & to guide the token amount, price and investor expectations.

Selection of Blockchain Platform

Select a scalable, safe blockchain that meets your technical, transaction cost & regulatory needs such as Ethereum or Hyperledger.

Smart Contract Development

Make programmable contracts to automate blockchain governance, ownership rights, transferability & token regulations.

Token Creation

Create digital tokens that represent a fractional ownership of an asset using smart contracts deployed on a chosen blockchain network

Investor Onboarding

Before allowing access to the token sale, conduct KYC/AML checks to confirm & authorize investors and ensure legal compliance

Token Issuance

Distribute tokens to verified investors through a regulated Security Token Offering (STO) platform, private sale or public launch.

Secondary Market Trading

Enable token trading on peer to peer platforms or regulated digital asset exchanges to increase market accessibility and liquidity.

Ongoing Asset Management

Use blockchain to manage ownership records, pay dividends, track performance & uphold transparency & legal compliance

Tokenized Assets Investment Opportunities

Asset tokenization on blockchain is leading the way to new market opportunities in almost every sector, with the ability to tokenize assets the traditional investment methodologies are revamping and revolutionising.

Real Estate

Tokenizing real estate properties like buildings, monuments, infrastructural designs, antique pieces, land, rental space, etc brings in wider opportunities for investment and growth. Eventually, it allows fractional ownership, which is one of the most popular aspects to gain global attention on real estate tokenization services.

Eventually, it allows fractional ownership, which is one of the most popular aspects to gain global attention on real estate tokenization services.

Art & Collectibles

Art was the very first niche to explore tokenization, from visual arts to digital art, and its branches have the potential ability to be tokenized. This has also made it possible for investors to own a fraction of expensive artworks or collectibles. Providing an opportunity for a broader crowd.

Private Equity

Tokenization can provide liquidity to the traditionally illiquid private equity market where the shares can be converted into digital assets that are easy to track and trace, while also secured by the layers of security in blockchain.

Commodities

Commodities including renewable, and nonrenewable resources like gold, and oil are also being tokenized to allow for fractional ownership, more accessibility, visibility, and transparency over the asset.

Currencies

Tokenization of fiat is also a new space to uncover the possibility of tokenization. This has been nurtured in space.

Retail Investors

With the democratisation of property, the inaccessible market is now becoming more accessible. Retail investment is one such avenue with growing interest among retail investors. This provides a versatile portfolio for investors.

Revenue Model In Asset Tokenization For Investors

1. Capital Appreciation

The appreciation in price, which is the profit gained through an increase in the value of the token over some time, is a similar way of revenue earned as in the case of traditional investing. Market speculation is also another opportunity to multiply the revenue stream.

Where this is done by the participation of a few investors who make short-term investments by trading assets to gain profit amidst the fluctuation in the market.

2. Dividend Payments

There is a token that distributes a part of profit based on the portion earned as dividend tokens, the token holder gains an additional benefit like the one receiving from the stock value increase. While there are also cases that the value of the underlying asset scales up, the dividend is gained for the same as the token value increases, and the income opportunities are maximised.

3. Voting Rights

Through governance tokens, where the holders get the ability to vote for or against the regulatory updates of the platform and ecosystem, they provide investors a direction towards the growth of the project and potentially increase the token value.

4. Utility and Usage

Token utility and usage also have a great potential to scale up the token value within the ecosystem. There are chances for the token value to increase, grow, and multiply based on the adaptation. Say a token used to govern in DeFi in a platform can appreciate its value as the platform becomes more popular.

5. Secondary Market Trading

The resale mechanism is the key profit policy for investors holding assets by selling in the secondary market palace to other investors, eventually, the value of the token is based on the demand that prevails in the market.

6. Staking and Yield Farming

Rewards is the main revenue model here. Through tokenized assets, Staking rewards and yield farming opportunities can be gained for the investors. By holding the token in the wallet and providing liquidity of the same, through decentralised exchanges, investors earn additional rewards.

7. Real-World Benefits

The token represents ownership of the asset and the investor benefits from the underlying asset’s appreciation and the income generated through it. When a real estate property share is tokenized, the investor is entitled to gain the rental income, and also benefit from the value of the increase in the property.

These are not just the possible revenue opportunities that are up for investors but they also explore other opportunities for sourcing income, which will be based on the revenue model, type of project, token, and other aspects revolving in and around the projects.

Benefits Of Asset Tokenization For Holders

With real-world asset tokenization, there are several benefits that you can extract while replacing Asset tokenization for Traditional transfers.

1. Reduced Transaction Cost

The traditional method of transferring assets involves a lot of involvement from third parties like banks, brokers, lawyers, financial institutions, etc. while blockchain eliminates the need for third parties and cuts down the major operation-orientated cost that is involved. Thereby enabling the asset to have low transactional cost.

2. Improved Transparency

Blockchain’s main quality transparency is effectively achieved, as all its records are maintained in the public record or ledger, and the stakeholders can verify and audit the transaction independently. The whole process of tokenization and others in coherence are on chain events that are open to track.

3. Simplified Fractional Ownership

Any tokenized world asset, say it be real estate, metals, artwork, etc can be divided and fractionalised into small units as tokens that can also be traded and eventually inviting all small-scale investors to make their investment and experience the freedom of democratised access.

4. Instant Transaction

The asset transfer on the blockchain, including cross-border transactions, is quick and easy while the traditional form will take days and months to transfer. This reduces the waiting time and also cuts down major labour.

5. Immutable Ledger

The decentralised nature of blockchain and cryptographic hashing is more secure, especially around malicious attacks. The transactions once entered into the ledger are immutable and no single entity can be altered from the past transactions.

6. Access to the Global Market

The broader the access gets, the broader the visibility. Tokenization is open to the global market and breaks demographic restrictions, subject matters, languages, etc. while meeting the regional rules and regulations is more than enough.

Legal Regulatory Compliance Used in Asset Tokenization

The legal frameworks of asset tokenization are crucial; they follow a set of rules to safeguard investors’ tokenized assets and data securely. Let’s begin to explore the comprehensive legal factors that impact tokenizing assets from the section below.

Regulatory Standards - The regulatory frameworks vary across different countries to verify that the trading and token management meet local standards.

Investor Protection Laws - It specifically focuses on protecting investors from fraudulent actions while building complete trust, transparency, and ownership of their tokenized assets.

Security Regulations - The majority of the tokenized assets protect users and assets from illegal public activities, ensuring a smooth trading operation.

Smart Contract Audit & Compliance - This ensures that the smart contracts legally govern the tokenized assets and align with the local contract laws to prevent illicit activities.

Data Privacy & Cybersecurity - All tokenized assets comply with the privacy and cybersecurity regulations to protect users' sensitive financial data from hackers.

Cross-Border Regulations - This regulatory framework often involves multiple jurisdictions, ensuring that the tokenized assets comply with international licensing and trading regulations.

AML and KYC - Compliances such as AML & KYC are used in asset tokenization to secure the tokenized assets from misuse, fraudulent activities, money laundering, or any other illicit activities.

How to Get Started with Asset Tokenization on Blockchain

When you planning to get started with Asset tokenization, it is very important to

Identify Your Niche

Understand the niche that you are choosing, to gain clarity on your target investor pool.

Pick a Sector

The sector that you want to explore or how innovative you are going to utilize in your day-to-day activities.

Set Clear Goals

Following that it is important to have clarity around the goals or milestones you are aiming to achieve through asset tokenization.

Plan a Roadmap

Having a defined road map on the same can also be very helpful around the same.

Define Investment Pool

Going forward, your investment pool for tokenizing should be defined.

Choose Tech & Network

To tokenize your real-world asset, choosing the right developer team and the network is equally important.

When choosing your Development partner ensure they have good updated knowledge and experience in what you want from them. With a clear definition of your goals, it's easy and more convenient to take to and explain your requirements.

At BlockchainX we do various blockchain development services. In our past 7 years of experience, we have been continuously evolving and learning the new aspects of blockchain and decentralisation. Where they don't just stay as theories but also have implemented many projects which today have a great reputation. We also specialise in asset tokenization.

Download the PDF : Asset Tokenization.pdf

Conclusion

Now that with so much input and detailing on Asset tokenization on Blockchain, there are a lot of aspects of this blog that were useful, while also tailoring informative content on trending topics, our expertise in asset tokenizations is also nurturing. Future ownership and investment are being transformed by blockchain-based asset tokenization.

It allows for fractional ownership, more liquidity and safer more transparent transactions by transforming physical assets into digital tokens. Tokenization makes it easier for a wider variety of users to access high-value assets that were previously only available to a select few such as commodities, real estate, artwork and business shares.

This comprehensive guide has guided you through the basics, advantages, types and a step by step procedure to get you started. Tokenizing your assets can open up new opportunities and increase efficiency if you have the proper plan, legal clarity and technical assistance.

Asset tokenization is expected to be crucial in creating a more digitized and inclusive financial environment as blockchain technology develops. Now is the ideal moment to begin exploring the future of asset management and investment. Connect with our experts today to get your real-world asset tokenized and gain more traction in global endeavours.