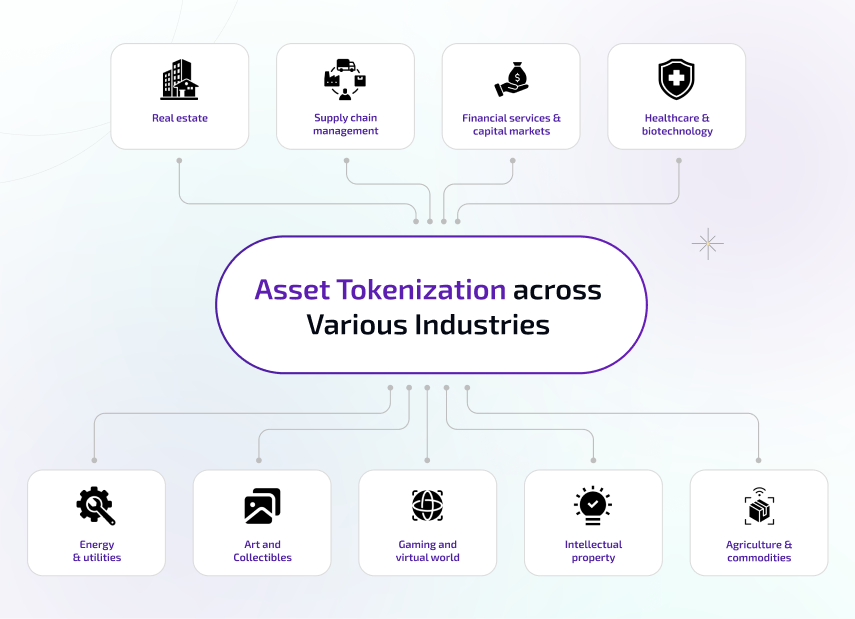

Asset tokenization on various industries : 9 Industries to watch

13 November, 2024Asset tokenization is shaking up businesses around the globe by converting tangible and intangible assets into blockchain-based tokens that provide remarkable liquidity, accessibility and transparency. Asset tokenization on various industries is making fractional ownership possible, opening up new investment opportunities and simplifying complex transactions from various industries including real estate, commodities and even intellectual property. Supply chain management, arts, banking and other sectors are already benefiting from tokenization which lowers barriers and makes high-value assets more accessible.

This blog will examine how asset tokenization is transforming numerous industries demonstrating the revolutionary potential of blockchain technology and the innovative ways it's being applied across many industries. Even if you are involved in real estate, supply chain management or finance, understanding asset tokenization can transform how you exchange and manage assets in the digital era. Lets dig in.

What is Asset Tokenization?

Asset tokenization is transforming tangible or digital assets into digital tokens in a blockchain. In blockchain platforms, the assets can be traded, transferred or sale of these tokens, just like cryptocurrencies do where these tokens represent ownership or fractional ownership of an asset. Tokenization makes it simpler to buy, sell or invest in assets like real estate, commodities, artwork, intellectual property and even securities to divide them into smaller pieces.

Features of Asset Tokenization

Fractional ownership

Tokenization, which divides assets into smaller pieces enables fractional ownership. As a result more people may become potential investors by lowering the entry barriers for high-value assets.

Liquidity

In the traditional view, assets like real estate or artwork are illiquid due to their difficulty in being converted into cash quickly. Enabling token holders to exchange portions of these assets on a secondary market and tokenization improves liquidity.

Transparency and security

Since tokens are based on a blockchain a decentralized ledger records all transactions related to the tokenized assets ensuring transparency and security. This lowers fraud and increases the efficacy of asset tracking.

Global access

By eliminating geographical restrictions, asset tokenization can make assets previously unavailable to investors due to physical locations or legal restrictions accessible to individuals worldwide.

Efficiency

By automating processes like ownership transfer compliance checks and settlement, blockchain technology speeds up transactions and reduces the need for middlemen.

Notable examples of Tokenized assets

Real estate

Property owners tokenize their assets enabling several investors to buy and sell portions of their holdings on secondary markets.

Art and collectibles

With tokenization, investors can purchase fractions of valuable artwork and unique collectibles without purchasing the complete item.

Commodities

Tokenizing gold, oil and other commodities can simplify investing in these physical assets through digital channels.

Asset Tokenization across Various Industries

Converting physical assets into digital tokens on a blockchain, a process known as asset tokenization makes it possible to have partial ownership, more liquidity and more transparency. Different industries implement asset tokenization in the following ways.

1. Real estate

Tokenization of real estate allows several investors to own a piece of the property by dividing it into smaller, exchangeable tokens. Because of this, real estate investments which were previously exclusively affordable by the wealthy are now more widely available to the general public. Because tokenized assets can trade on secondary markets without the time-consuming procedures associated with traditional real estate transactions and it also increases liquidity. Utilizing blockchain reduces the possibility of fraud by offering a visible and safe ownership record.

Benefits

- Reduces barriers

- Simpler cross border transactions

- More liquidity

Examples

- Property tokens that let investors purchase fractions of real estate, either residential or commercial.

2. Supply chain management

Tokenization enhances accountability and traceability in the supply chain. On the blockchain, every physical asset like a shipment or inventory item can be represented by a token that gives users real time access to information about its location and status. Tokenization enables stakeholders to confirm the authenticity of goods, thwarting counterfeiting and guaranteeing adherence to legal requirements.

Benefits

- Reduced fraud

- Cost optimization

- Improved inventory management

Examples

- Digital tokens that stand in for products, supplies or shipments can expedite payments and strengthen security.

3. Financial services and capital markets

Tokenized financial assets such as stocks and bonds enable more efficient trading and settlement procedures. Financial institutions can lower transaction costs and make these assets more accessible to regular investors by issuing tokens that signify ownership. Tokenization makes fractional ownership 24/7 trading possible facilitating smaller investors' participation in capital markets.

Benefits

- Greater market involvement

- Quicker settlement durations

- Lower expenses

Examples

- Tokenized bonds or shares are traded on decentralized markets.

4. Healthcare and biotechnology

Asset tokenization can help the healthcare industry securely share patient data, clinical trial findings and innovation-related intellectual property. Patients maintain control over their data by tokenizing medical records and they can decide whether to give it to institutions or researchers for study or payment.

Benefits

- Patients data control

- Better data security

- Improve sharing of medical research

Examples

- We can use tokenized patient information for clinical research or tokenized rights to the intellectual property of biotech breakthroughs.

5. Energy and utilities

Tokenization in the energy sector enables more effective trading of carbon offsets and renewable energy credits.Companies can exchange these assets on decentralized platforms improving market liquidity and transparency by issuing digital tokens. Tokenization also facilitates decentralized energy markets which encourage sustainability and the use of cleaner energy sources by enabling individuals to directly engage in renewable energy projects and get incentives for their contributions.

Benefits

- Encourage the use of renewable energy

- Decentralized energy systems

- Simplify energy credit trading

Examples

- Solar energy tokenization allows houses or residents to directly sell and buy excess energy to customers

6. Art and Collectibles

Tokenization serves as a perfect tool for the art market enabling the division of precious pieces into shares that investors can purchase.Investing in art can become more accessible with this strategy which provides a simple way to track ownership and provenance. The possibility to sell tokenized valuables such as rare coins or vintage products on blockchain platforms creates new markets for investors and collectors.

Benefits

- Safe provenance tracking

- Enhanced liquidity

- Broader market access

Examples

- Tokenizing digital art as NFTs (Non-fungible tokens) or fractional ownership of valuable artworks

7. Gaming and virtual world

Tokenization in the gaming industry gives gamers the ability to own in-game items like virtual real estate, weaponry and skins. Through the use of blockchain technology, developers can guarantee the uniqueness and legitimacy of digital assets improving the player experience and opening up new revenue opportunities for them through token sales and royalties.

Benefits

- Transparent ownership of digital assets

- Cross-platform asset mobility

Examples

- For digital products NFTs for in-game assets allow for the rise of a secondary market.

8. Intellectual property

Tokenization enables inventors and creators to manage and monetize intellectual property rights more effectively. Creators can issue tokens that represent ownership or rights to patents, copyrights or trademarks to streamline licensing deals, secure royalties and attract investment. This procedure improves IP transparency and traceability in addition to increasing revenue prospects.

Benefits

- Fractional ownership

- Simpler IP monetization

Examples

- Tokenized patents let several investors jointly own and provide licenses for an invention.

9. Agriculture and commodities

Tokenization in agriculture allows farmers to pre-sell portions of their produce by representing crops, livestock and agricultural products. This process provides farmers with more liquidity and provides investors with a way to support agricultural initiatives. Monitoring product quality and provenance ensures food safety and facilitating better resource management throughout the agricultural process enhances supply chain transparency.

Benefits

- Trading goods like grain, oil and precious metals

- Transparent supply chains

Examples

- Tokenized goods like grain, coffee or cattle facilitate commerce and investment

The Advantages of Asset Tokenization

1. Immutability

In Tokenization, immutability ensures data on the blockchain cannot be changed. This reduces fraud and data tampering by creating a safe and reliable environment for tracking ownership and transaction history.

2. No middlemen

Brokers, agents and banks frequently serve as middlemen in traditional asset management and trading increases the expenses of this process. Elimination of the necessity for middlemen enables parties to transact directly with one another. This improves system efficiency by significantly reducing transaction costs and processing delays.

3. Quick & cheaper transactions

It eliminates traditional delays in transaction processing enabling instantaneous settlements. This helps buyers and sellers by cutting down on the time and expenses involved in changing ownership and making deals.

4. Security

Due to its decentralized structure and use of cryptographic techniques–blockchain is impossible for hackers to penetrate or alter. Blockchain ensures the safety of assets from online attacks and unwanted access by safely recording all transactions and shielding ownership information transparency in regular complaints.

5. Transparency in regulatory compliance

Since blockchain is auditable–regulatory compliance is more transparent. An unchangeable ledger records each transaction and ownership change, giving authorities and auditors access to accurate and verifiable data. This makes it easier to comply with anti-money laundering (AML) and know your customer (KYC) regulations guaranteeing that tokenized assets adhere to all legal requirements.

6. New financial models

It makes new financial models possible. Tokenization allows for the trading of previously hard-to-trade or illiquid properties like real estate, fine art or private equity in more manageable and smaller chunks. This democratizes and increases the accessibility of investing options for a larger population. Furthermore, decentralized finance (DeFi) applications can use tokenized assets for lending, collateralization and other financial activities, creating new revenue streams.

Facing the challenges of Asset Tokenization

Legal uncertainty

Tokenization frequently occurs in a state of legal confusion where several jurisdictions have regulations about digital assets that are unclear or changing which makes it challenging for companies to guarantee complete compliance.

Market adoption and liquidity

Although tokenized assets may have advantages and even market adoption may be sluggish which would reduce liquidity. Because of their inexperience or the low trading volume in tokenized markets, investors could be reluctant to participate.

Current security risks

Despite the perceived security of blockchain technology tokenized assets remain vulnerable to fraud, hacking and cybersecurity risks. This is especially relevant if there are security issues with smart contracts or the underlying platforms.

Education gap

Many potential customers, business professionals and investors are not well-versed in tokenization and blockchain technology. This slows adoption and raises the possibility of misuse or mismanagement.

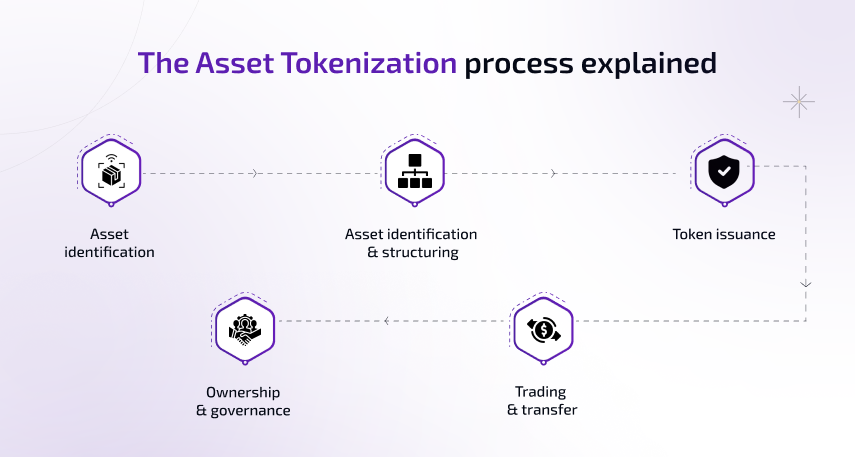

The Asset Tokenization process explained

Asset identification

The first step in the asset identification process is to identify the asset that requires tokenization. In addition to financial assets like bonds and stocks, this can also refer to tangible assets like real estate, precious metals and artwork.

Asset identification and structuring

We value the good and tokenize it after identification. We must determine the assets total worth and divide it into smaller portions known as tokens to accomplish this. The value of each token is only a small part of the entire asset value.

Token issuance

The third stage involves issuing the tokens on a blockchain network. Typically we produce these tokens using smart contracts which are self-executing contracts that explicitly put the terms of the agreements into code.

Trading and transfer

On exchanges or platforms that rely on blockchain technology, tokens can be traded and transferred once they are issued. This facilitates quick and simple transactions reducing the need for middlemen and transaction costs.

Ownership and governance

One of the many transactions that the blockchain transparently and irreversibly records is ownership of the tokens. In addition to other governance powers, token owners may be able to cast votes on matters of the underlying asset.

Future Outlook for Asset Tokenization

The following is the prediction for the developments of asset tokenization in the upcoming years.

1. Enhanced regulatory clarity

Businesses will feel more comfortable entering tokenized marketplaces as governments and regulatory organizations provide clearer rules for digital assets. This clarity will ensure compliance and encourage innovation which will increase adoption among the public.

2. Asset class expansion

There will be a greater variety of tokenized asset classes in the future encompassing both tangible and intangible assets such as digital goods and intellectual property as well as tangible assets real estate, commodities and artwork. This growth gives investors more portfolio options.

3. Adding in DeFi

The addition of tokenized assets to DeFi platforms creates new revenue streams such as the ability to borrow against tokenized assets and earn interest.

4. Sustainability and social impact

Tokenization will increasingly link with sustainability initiatives enabling transparent tracking of social and environmental impacts. Tokenized assets could be used to fund projects that work toward social justice.

5. Structures for DAO ownership

Tokenized assets will have new ways of being owned because of decentralized autonomous organizations (DAOs). Asset ownership will become more democratic, which means that more people will be able to spend and make decisions.

6. Collaboration across industries

Expect collaboration among industries to investigate inventive tokenization uses. For instance cooperation between the finance and supply chain industries may lead to the development of new concepts and commodity monitoring systems.

Conclusion

Use BlockchainX right now to find out what blockchain can do! It is easy and quick to tokenize your assets with our help whether they are financial, real estate or digital goods. Our blockchain experts will walk you through every step of the process and offer custom solutions to make sure the exchange goes smoothly and quickly.

Are you ready to use blockchain technology to change your business? Please contact us immediately to learn how we can help.